Advertisement

Opinion | Why 2023 will be remembered as a tipping-point year

- From the collapse of banks in March and the Federal Reserve’s interest rate increases, to the impact of geopolitics on trade and the rising number of armed conflicts, this year has seen an acceleration in mega trends

Reading Time:4 minutes

Why you can trust SCMP

5

This year will be remembered as a tipping point when almost all the mega trends of finance, technology, trade, geopolitics, war and climate change showed signs of increase in speed, scale and scope. You can call this a state of permacrises, a series of cascading shocks that seem to be building up to a bigger catastrophe.

Advertisement

In finance, we saw the collapse of Silicon Valley Bank in the US on March 10, followed by that of Signature Bank. The Federal Reserve and Federal Deposit Insurance Corporation acted fast to guarantee all deposits to stop “Twitter-fuelled bank runs”.

In Switzerland, Credit Suisse was taken over by UBS on March 19, after the bank lost nearly US$75 billion worth of deposits in three months. Swiss financial credibility was hurt when holders of Credit Suisse Additional Tier-1 bonds became outraged that they would suffer writedowns ahead of equity holders.

Although prompt action by the Fed and Swiss financial authorities averted global contagion and restored calm to financial markets, the Fed raised interest rates four times this year to 5.25-5.5 per cent to tackle inflation. This month, gold prices touched a record high of US$2,100 per ounce, signalling anticipated inflation abatement, but escalated geopolitical tensions.

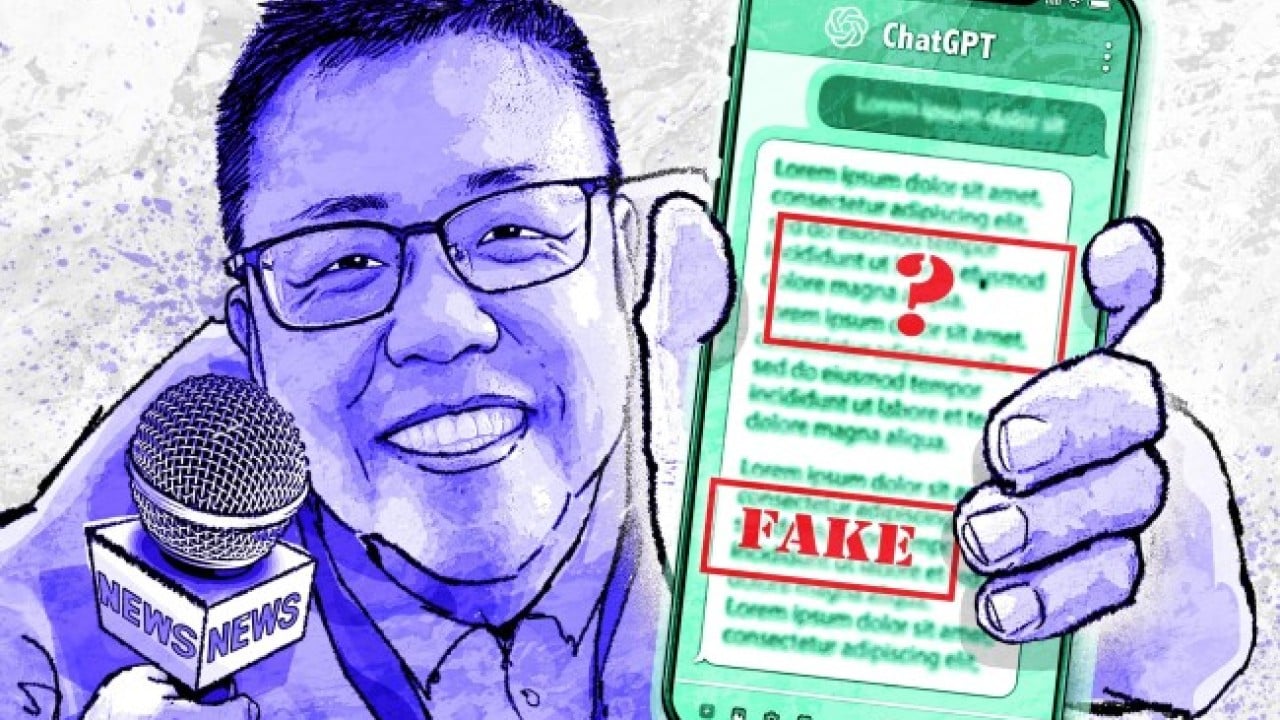

In technology, 2023 marked the seismic arrival of generative artificial intelligence, following the public launch of ChatGPT in November 2022. Commercialised AI is considered the next big thing, sparking a US tech stock rally, which helped avert a year of portfolio losses in financial markets hurt by interest rate hikes.

In trade, the latest United Nations Conference on Trade and Development (UNCTAD) Global Trade Update estimated that global trade would shrink by 4.5 per cent year on year to less than US$31 trillion in 2023, with trade in goods declining by nearly US$2 trillion and trade in services expanding by US$500 billion. The outlook for 2024 is pessimistic because trade issues are now geopolitical, rather than purely market-driven. Global supply chains are either decoupling or de-risking to avoid sanctions.

Advertisement