Advertisement

Advertisement

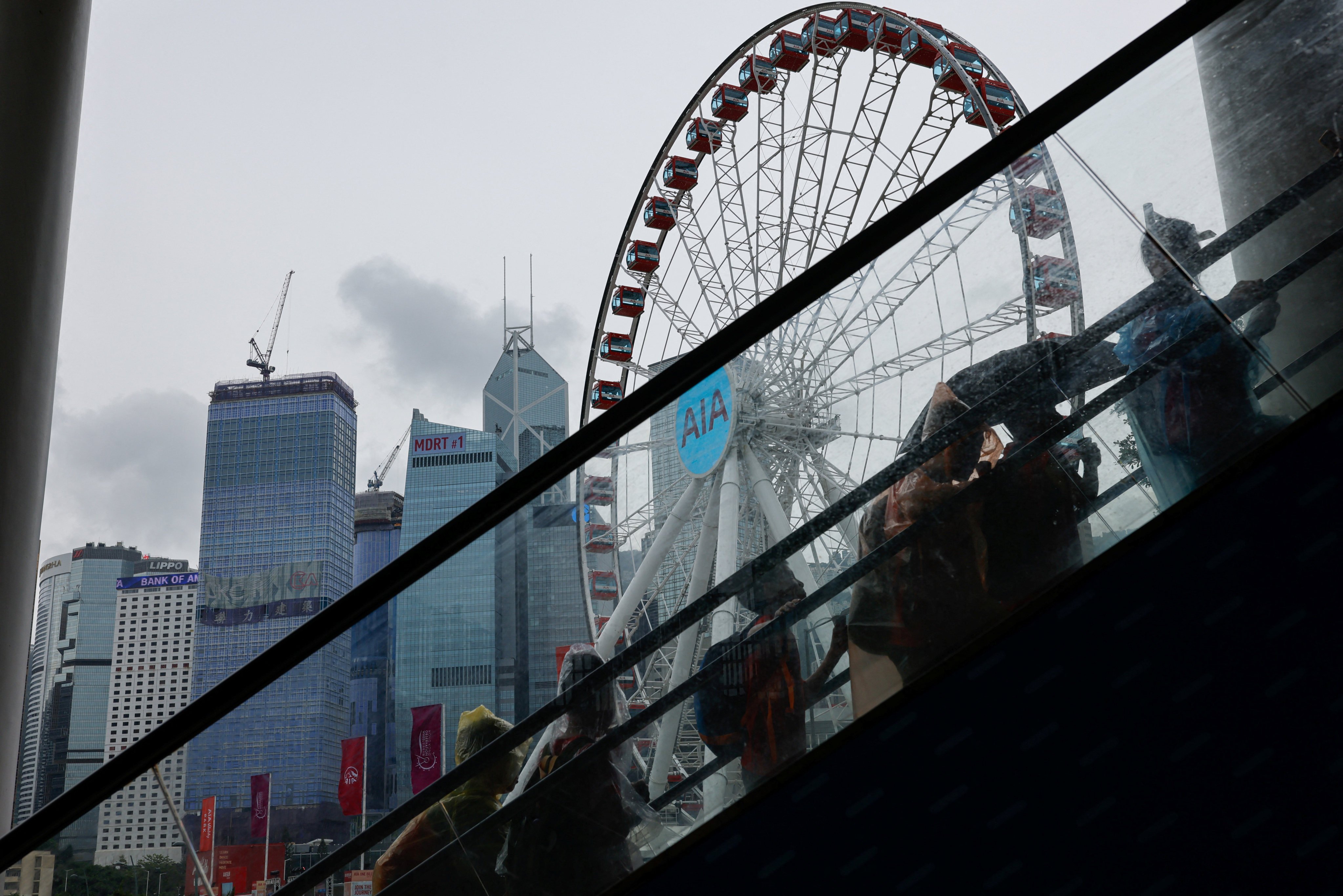

Andrew Sheng

Andrew Sheng is a former central banker and financial regulator, currently distinguished fellow at the Asia Global Institute, University of Hong Kong. He writes widely on Asian perspectives on global issues, with columns in Project Syndicate, Asia News Network and Caijing/Caixin magazines. His latest book is “Shadow Banking in China”, co-authored with Ng Chow Soon, published by Wiley.

It’s not just market volatility. We need to understand the deep structural forces sometimes beyond any single national regulator’s power.

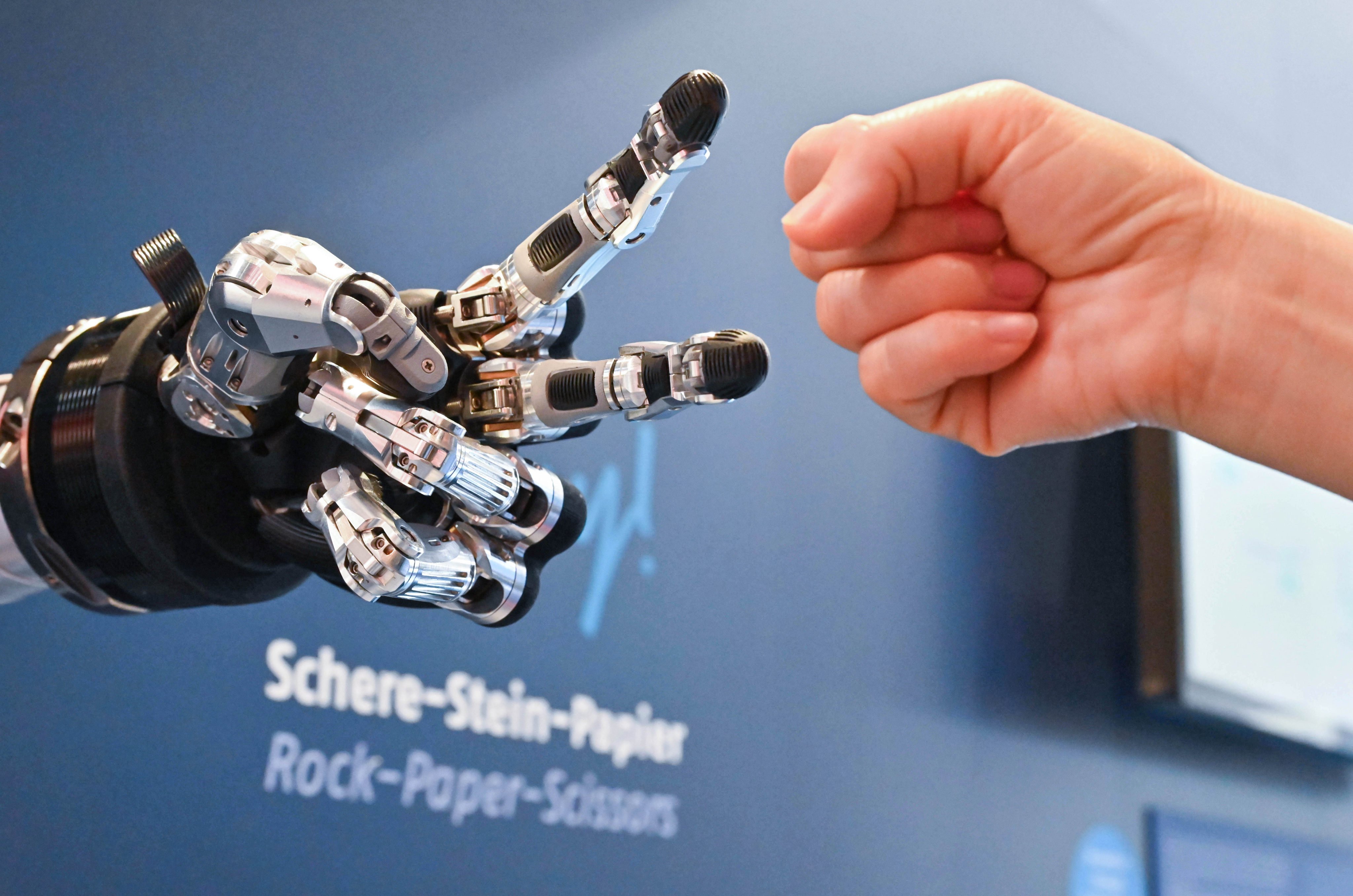

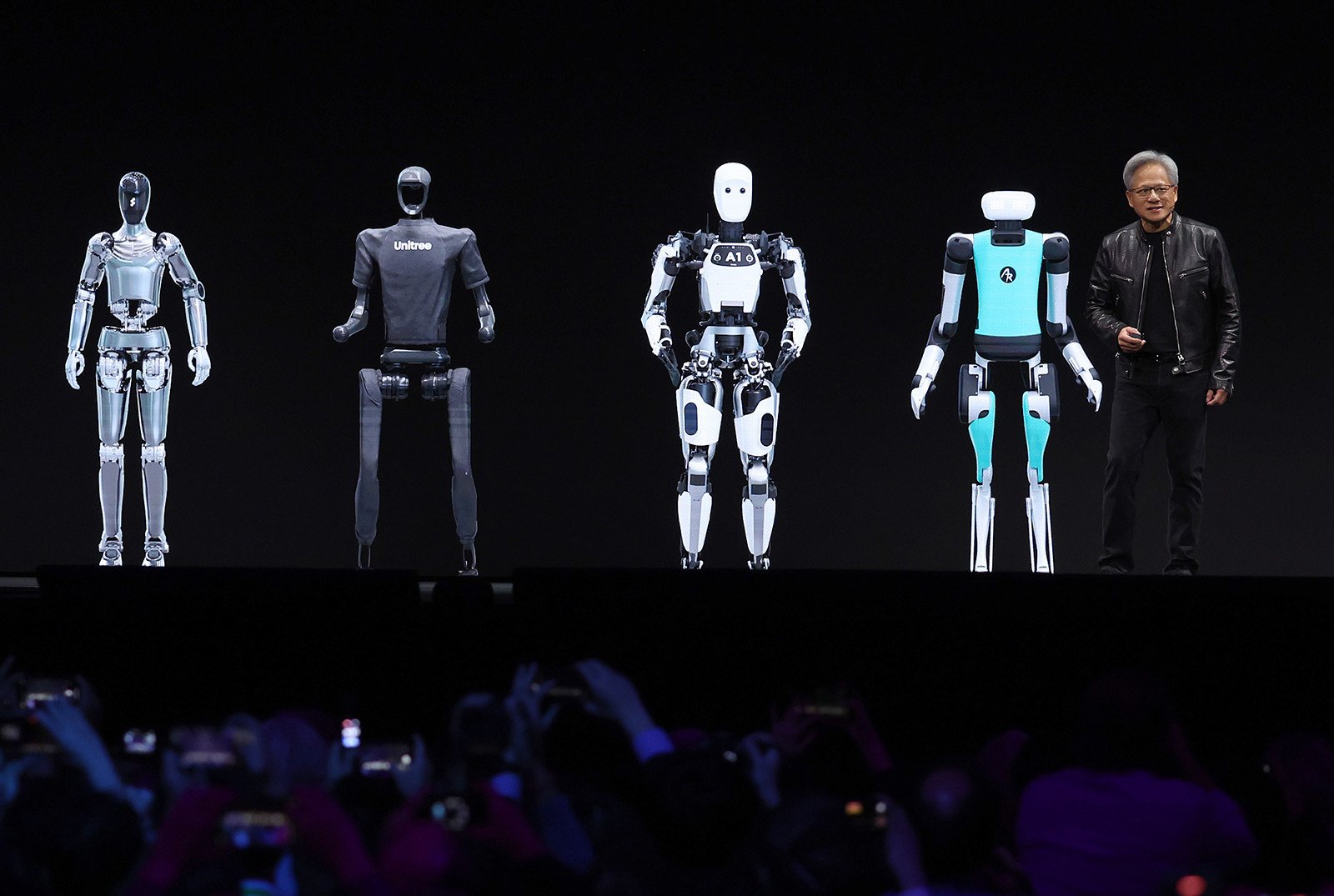

Delegating artificial intelligence to experts and specialists risks a future of low productivity, worse income inequality and more market concentration.

The Global South is right to demand change of a global financial system that is neither ecologically nor financially sustainable.

Lower US rates, helped by Japan’s normalising policy, would boost liquidity and ease dollar pressure, with better days ahead for emerging markets.

Advertisement

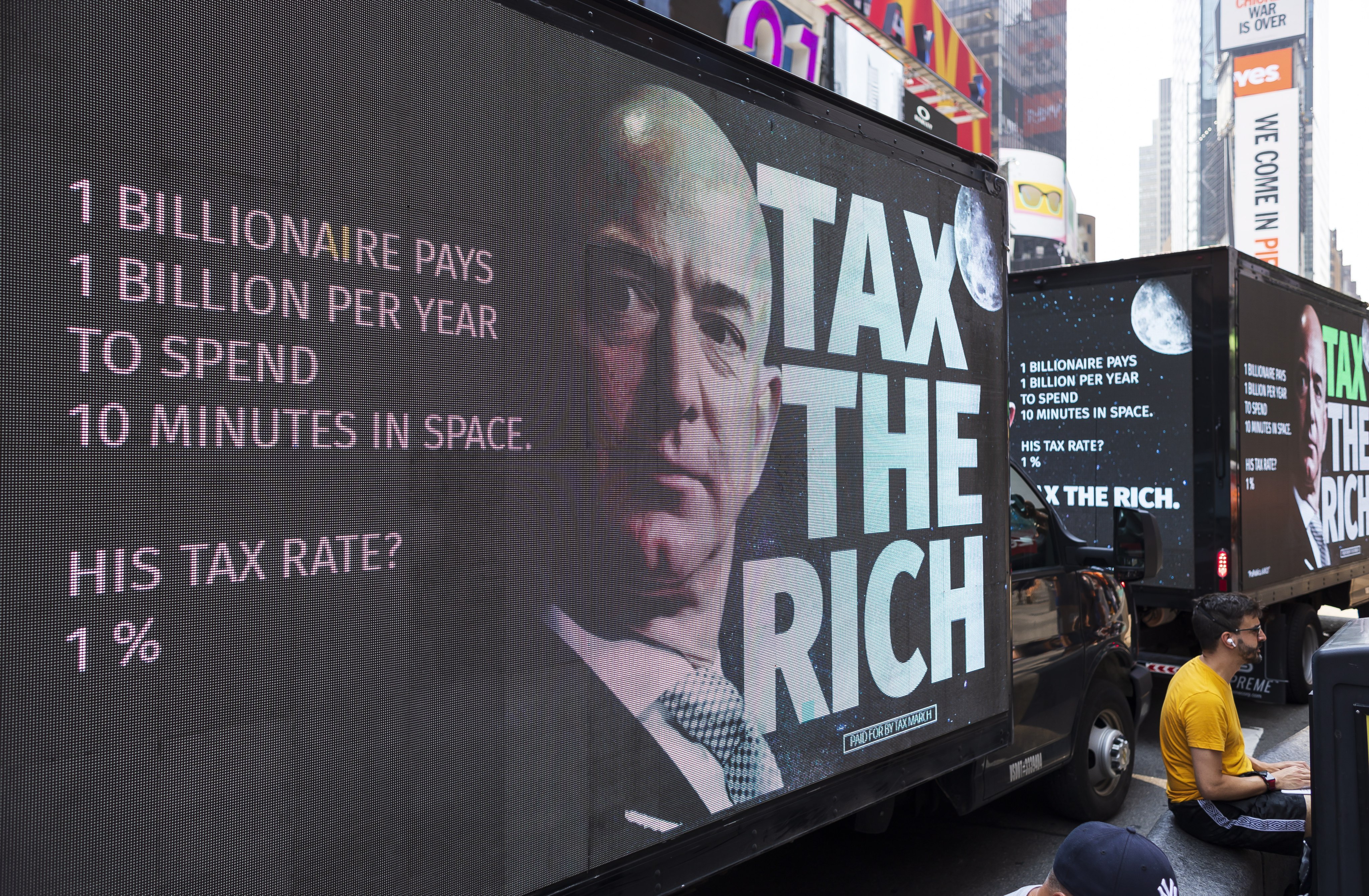

While the risk of America’s debt is shared by global lenders and investors, US leverage makes the burden far from fair.

If leading central banks can grow their balance sheets by billions of dollars during the pandemic, they can do the same to fight climate change.

We all need to adopt AI tools to achieve more with less but this change needs to be engineered with leadership, courage and passion.

If Europe wants to reverse the steady erosion of its competitiveness and technological leadership, it must adapt to the promise of AI.

In a world of contending powers with greater risks and uncertainties, the free-market model with one dominant hegemon may no longer be suitable, given the urgent need to tackle social and environmental injustices.

Those who curb real trade and expand financial sanctions don’t seem to understand the likeliness of a destructive outcome for all. The West is wrecking the foundations of its prosperity.

Globalisation didn’t hurt US jobs, contrary to what American politics would have you think. Still, in a fractious era of more trade barriers, economies like Hong Kong can contribute to seamless global trade by adopting digital documentation.

It is no coincidence that some of best chip makers in the world also have long traditions of wax tie-dye, which requires craftsmanship and cooperation.

If the tech sector cannot solve climate change and social inequality – the two existential issues of our time – the state must step in. Unfortunately, geopolitical tensions are such that governments appear more preoccupied with rivalry and industrial policies than solving problems.

The US has returned to growth, with a strong stock market and lead in AI technology but the global leadership contest is far from over and counting on the US as the key engine of recovery is simply not realistic.

Whether it’s macroeconomic modelling or export-led industrialisation, the game has changed with peak globalisation, technology diffusion and climate change. Development and how to finance it is the question, and brave countries can adopt very different models from the past.

As the Global South pushes for more opening up, trade will emerge profoundly different, more complex and diffused. Chest-beating isolationism can’t change how the world is more interdependent than ever.

The idea of a Western garden under threat from the unruly jungles of the rest of the world is at the heart of today’s global rifts.

Expect a right-wing agenda, a Ukraine deal with Russia, a restrained Israel, truce with China, and European and other allies treated again as vassals. In other words, distant enemies will have less to fear than close allies.

The West’s imperial history means it has set many global standards since the 15th century, while the solidification of US hegemony after 1945 convinced many former colonies to buy into neoliberal ideology. More recently, though, it has become clear that the Global South must chart its own course to a sustainable future.

Overstretched by wars, undermined by fractious politics, and with the dollar, its most powerful tool, sorely overused, America is clinging on to a unipolar world order. But in putting America first, its leaders are dismantling the world order that Washington helped to build.

From the collapse of banks in March and the Federal Reserve’s interest rate increases to the impact of geopolitics on trade and the rising number of armed conflicts, this year has seen an acceleration in mega trends.

Tight coupling in a global world is breaking and we need a looser macro-management philosophy that allows for decentralised adjustments to different stresses and strains.

As global warming intensifies, the only alternative to destruction is cooperation, as shown by the US-China landmark Sunnylands climate accord ahead of COP28. But where is the money to fund such plans?

The West’s unqualified support for Ukraine and Israel has lost it the support of the rest of the world and arguably hurt its moral standing.

Concerns about global financial stability are growing amid slowing growth, rising oil prices and war in Ukraine and Palestine. Reports released by a series of top economists and regulators suggest many vulnerabilities remain despite efforts to curb systemic risks.

At a time when environmental, economic and political disasters are plaguing the planet, global leaders all seem either distracted or totally absent. Rich countries have a moral duty to take the risk of funding and leading global climate action and addressing social inequities.

The global financial system has failed to divert sufficient assets to support developing countries in meeting the Sustainable Development Goals. If the Global South is to be heard on the global stage and shape its own future, its financial institutions must step up.

Austrian scholar Friedrich Glasl’s model of conflict escalation tracks how disputes deteriorate from tension to total destruction. In the nuclear age, it is vital for political leaders to come to their senses and choose diplomacy, not war.

The world today is caught in a classic confidence trap. More government regulation cannot arrest the downward spiral, and policymakers must take a bet on the markets’ instincts for creativity and innovation.

When it comes to food production, water supply and carbon capture, our best chance of fixing things may be to work on the soil beneath our feet.