Advertisement

Abacus | US-China trade war: the financial markets are focused on the wrong risk

- US bond market investors have been acting in a terrifying fashion, assuming a deflationary shock is ahead.

- Such logic ignores trends from the last 30 years of globalisation

Reading Time:4 minutes

Why you can trust SCMP

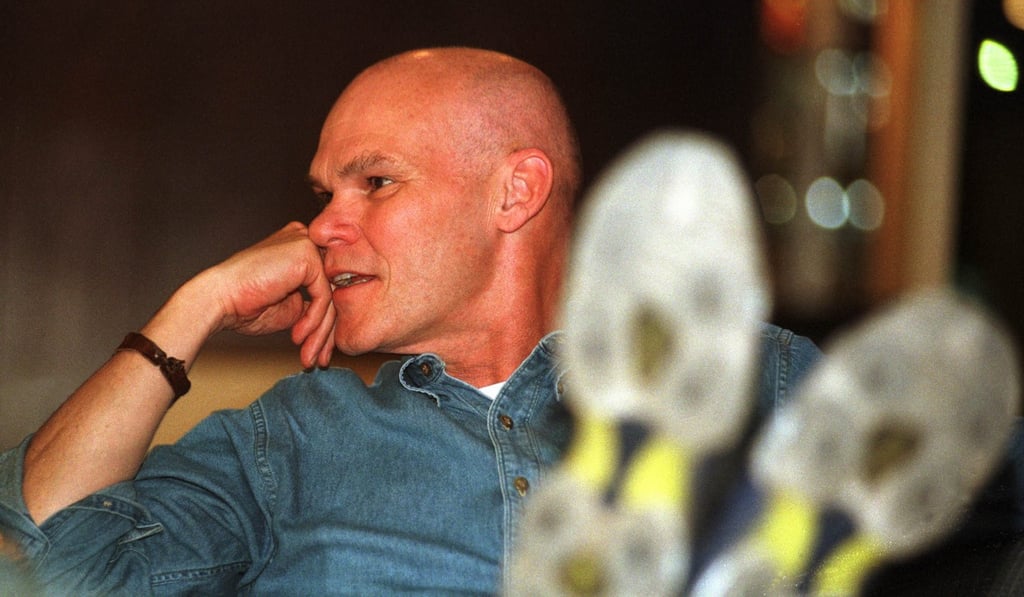

The US political strategist James Carville once said that after his death, he would like to be reincarnated as the bond market. “You can intimidate everybody.”

Advertisement

Well, the US bond market is a lot bigger and scarier today than in Carville’s time. The US Treasury bond market alone is worth some US$22 trillion. Then there is another US$7 trillion outstanding in US corporate bonds. And that’s without even considering all the US mortgage-backed securities out there.

And lately, as the US-China trade war escalated, threatening to reverse the globalisation trend of the last three decades, the bond market has been behaving in a fashion that is not just intimidating, but also downright terrifying.

Happily, however, there are some good reasons to believe the market may have got things wrong, and that the outlook may not be quite so frightening after all, or that at least it may be a different sort of scary.

Advertisement

While economists and politicians will be arguing about the impact of the trade war on the world’s economy for months, and probably years, to come, the bond market has already made up its mind.

Advertisement