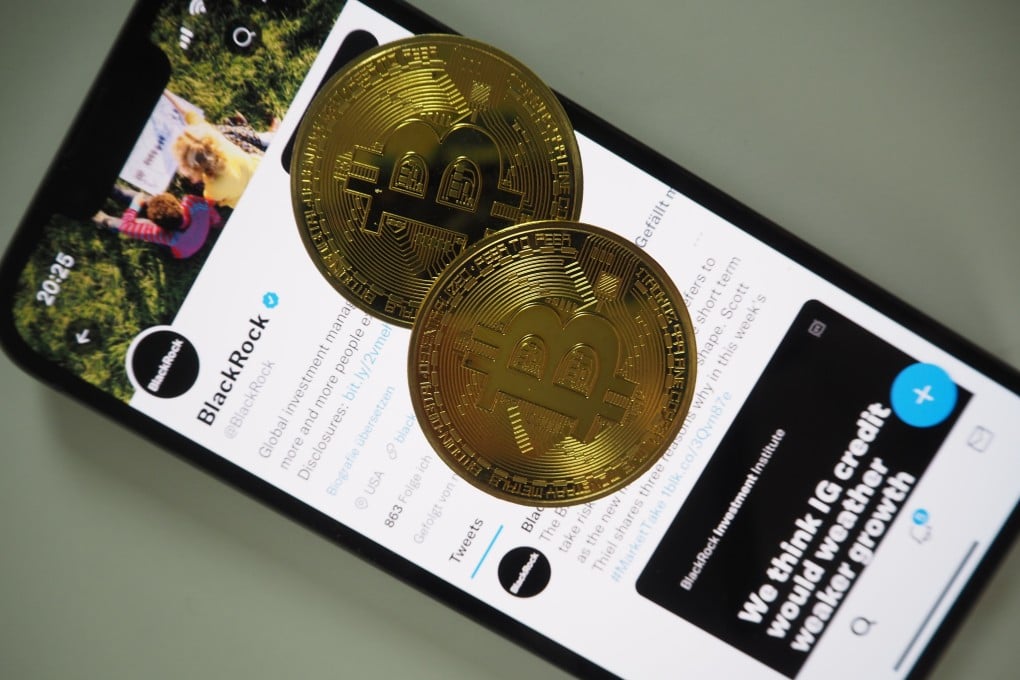

BlackRock’s US$20-billion ETF is now the world’s largest bitcoin fund, dethroning Grayscale’s rival crypto trust

- BlackRock’s spot bitcoin exchange-traded fund held US$19.68 billion in total assets as of Tuesday

- The firm’s iShares Bitcoin Trust has attracted the greatest inflow, totalling US$16.5 billion, since nine crypto ETFs debuted in the US in January

The BlackRock and Fidelity spot bitcoin ETFs were among nine that debuted on January 11, the same day the more than decade-old Grayscale vehicle converted into an ETF. The launches were a watershed for cryptocurrencies, making bitcoin more accessible to investors and spurring a rally in the token to a record US$73,798 by March.

The iShares Bitcoin Trust has attracted the greatest inflow, totalling US$16.5 billion, since going live in January, while investors have pulled US$17.7 billion from the Grayscale fund over the same period. The latter’s higher fees and exits by arbitrageurs have been cited as possible drivers of outflows.

Neither BlackRock nor Grayscale Investments immediately replied to requests for comment outside regular US business hours.