Advertisement

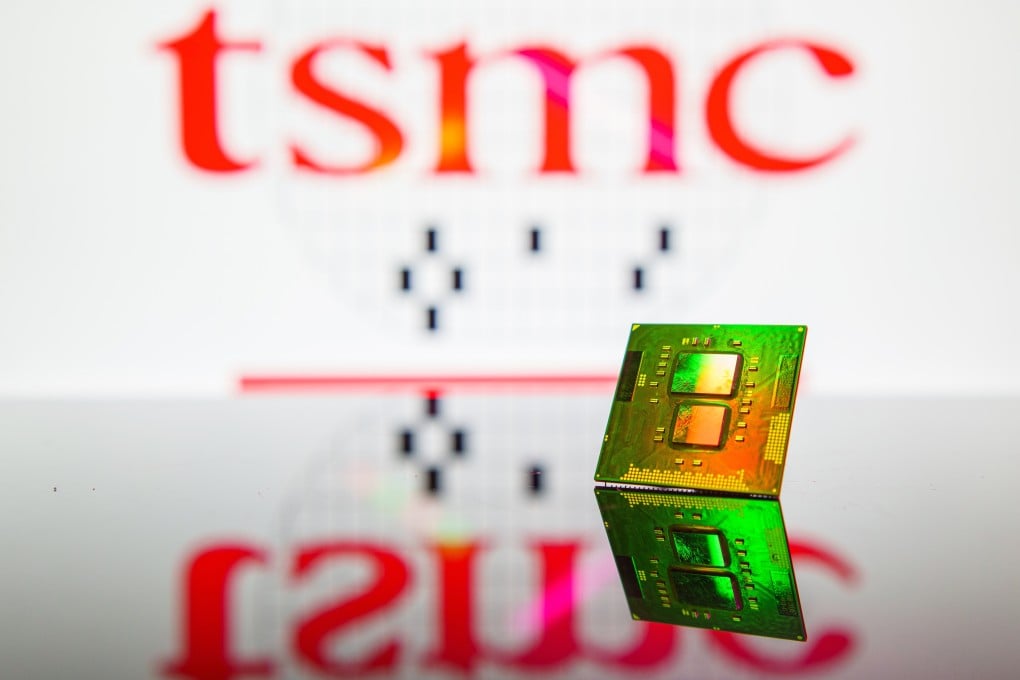

Nvidia chip supplier TSMC’s sales surge past expectations on AI infrastructure demand

- The world’s largest contract chip maker posted second-quarter revenue of US$20.69 billion, up 40 per cent from a year earlier

Reading Time:1 minute

Why you can trust SCMP

Taiwan Semiconductor Manufacturing Co (TSMC), the world’s largest contract chip maker, saw a surge in second-quarter sales on the back of the artificial intelligence (AI) boom that is fuelling investments in data centres worldwide.

Advertisement

The sole supplier of advanced chips for Nvidia Corp and Apple said on Wednesday that revenue for June came to NT$207.9 billion (US$6.39 billion). That means 40 per cent growth in the June quarter to NT$673.5 billion, versus the average projection for a 35.5 per cent rise.

TSMC’s latest quarterly sales figure comes days after the company briefly reached a US$1-trillion market capitalisation on a tide of investment into AI-related data centres and devices.

Businesses around the world are racing to buy up hardware, such as Nvidia chips, to build up AI-supporting infrastructure. That prompted Wall Street brokerages to lift their price targets for TSMC, citing the chip maker’s potential move to charge customers more in 2025 to elevate earnings further.

The AI chip orders have helped make up for lacklustre smartphone sales, which are only just emerging from a trough. Apple remains Hsinchu-based TSMC’s biggest customer.

Advertisement

Advertisement