London property market still attractive for investors despite stamp duty surcharge

New stamp duty tax on second homes in the UK won’t deter overseas buyers who recognise that buying London property is a solid, long term investment

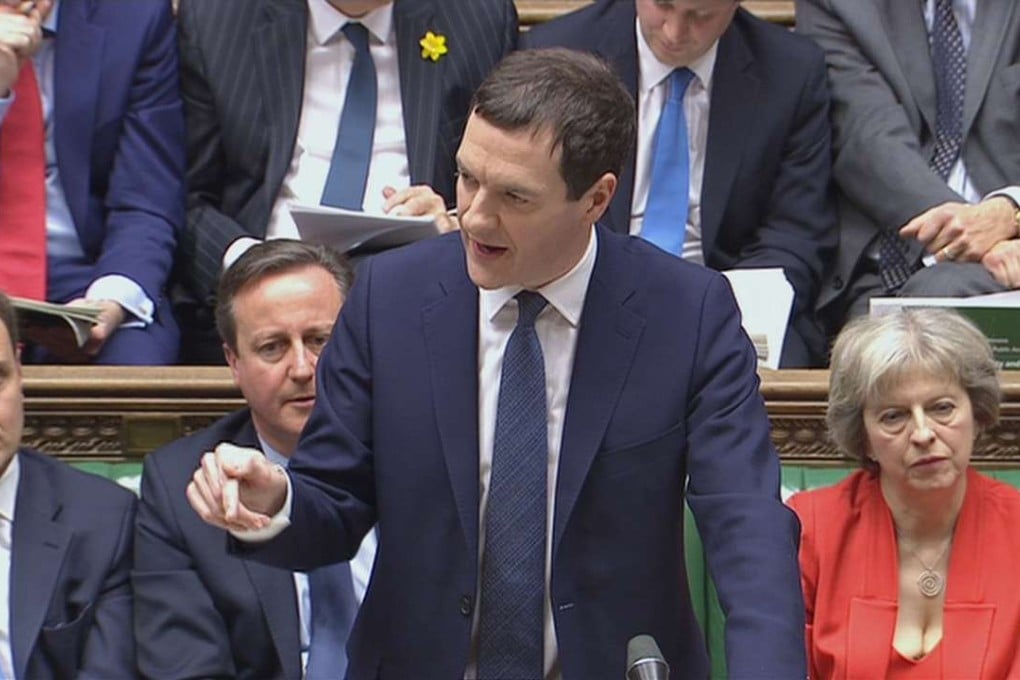

When UK Chancellor George Osborne gave his latest budget speech this time last week, overseas investors eyeing London property paid attention.

From April 1 they’ll pay more in tax after plans for a 3 per cent stamp duty surcharge on buy-to-let and second homes got the government green light.

The so-called “second homes tax” means anyone who snaps up more of the city’s red-hot bricks and mortar will need to stump up more cash upfront.

On the average London flat worth £532,758 (HK$5.9 million) that amounts to HK$362,934 in stamp duty rather than the HK$185,112 payable previously – an extra HK$177,822.

It has been dubbed punitive and left pundits dubious about what it means for the London’s property market. So what does it mean for overseas investors?

Speculation has been rife since late last year that the mooted Stamp Duty Land Tax (SDLT) changes will take the heat out of the investor market.