What’s the future of sustainability in Asia?

A rising pool of money is chasing better ESG practices. Governments are driving the transition to low-carbon economies.

[Sponsored Article]

In Asia, attitudes toward sustainable investing have changed radically in just a few years. Much of this shift started as top- down driven. Now a ground-up narrative is fast developing as private and institutional money chases better ESG disclosures and practices.

Top-down drive gaining traction

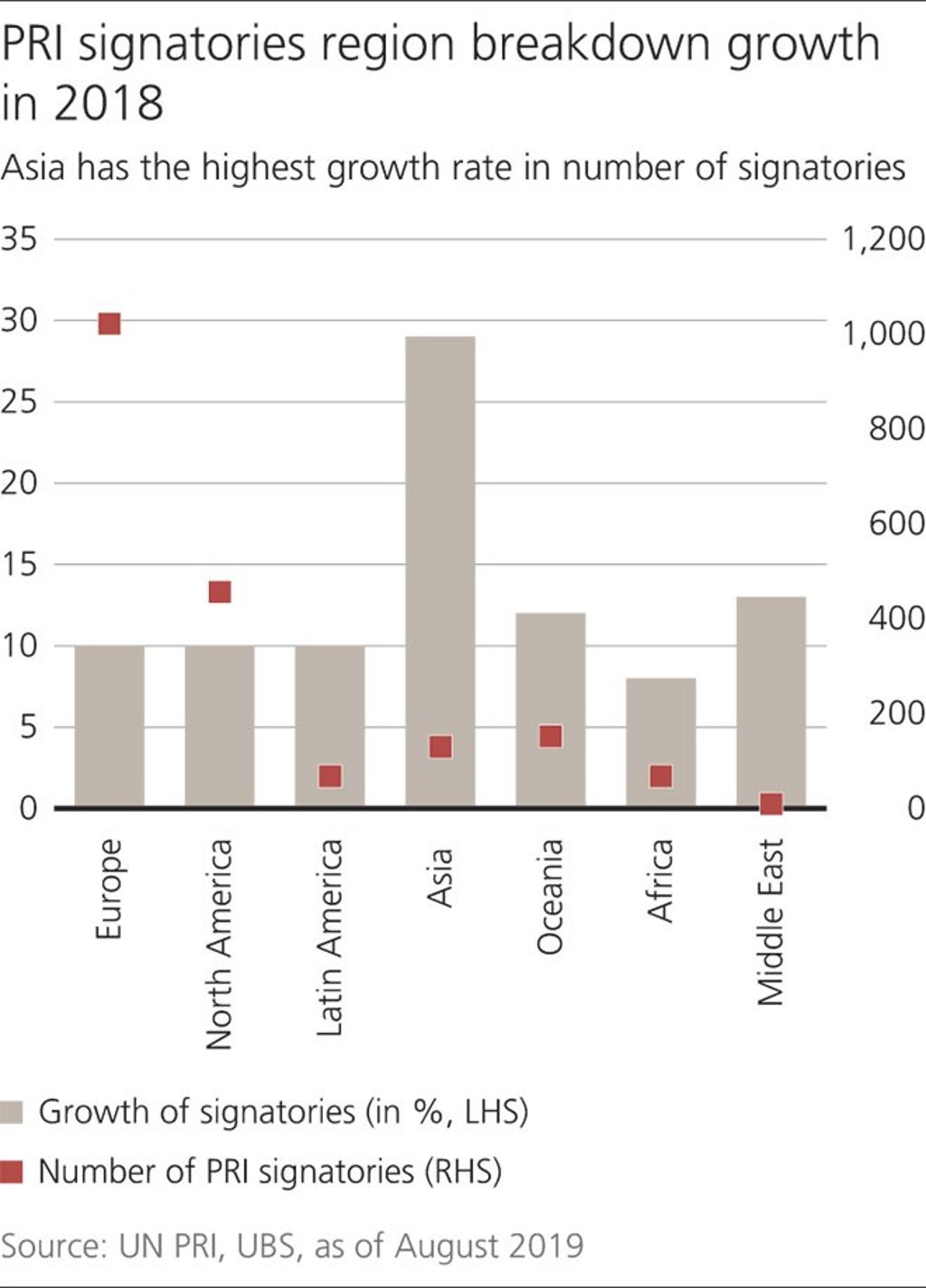

Sustainable investing (SI) has been growing across Asia, with over USD 10trn worth of assets under management signed up to the UN Principles for Responsible Investing in the past three years (2016–2019). The rise of SI in the region has been driven top-down by state asset owners and regulators. A key reason is that Asian governments now view SI as compatible with their policies to address the growth risks from climate change, the transition to a low-carbon world, inadequate infrastructure, shrinking labor forces and growing resource shortages. Asia also now has eight stock exchanges with mandatory ESG reporting, more than any other region in the world, and China, the Philippines and Indonesia plan to join the list next year.

Financing Asia’s sustainability challenges

Cities in China and India are forecast by the UN to receive 181m and 113m urban migrants, respectively, from 2015 to 2025. Asia is currently home to 22 of the 33 global megacities (cities above 10m) and will add nine more by 2030. Rapid urbanization and income growth depletes key resources, absorbs agricultural land and expands carbon footprints.

The issue of how to sustain a growing, urbanizing population without further harming the ecosystem is intensifying sharply. Climate change is an acute risk for Asia as most of its economic activity and megacities are on the coast or lie along river deltas. Inadequate attention to climate change risk could cost the region at least USD 2.8trn, based on an estimated 9% hit to regional GDP as a result of rising sea levels under the RCP 8.5 climate scenario.