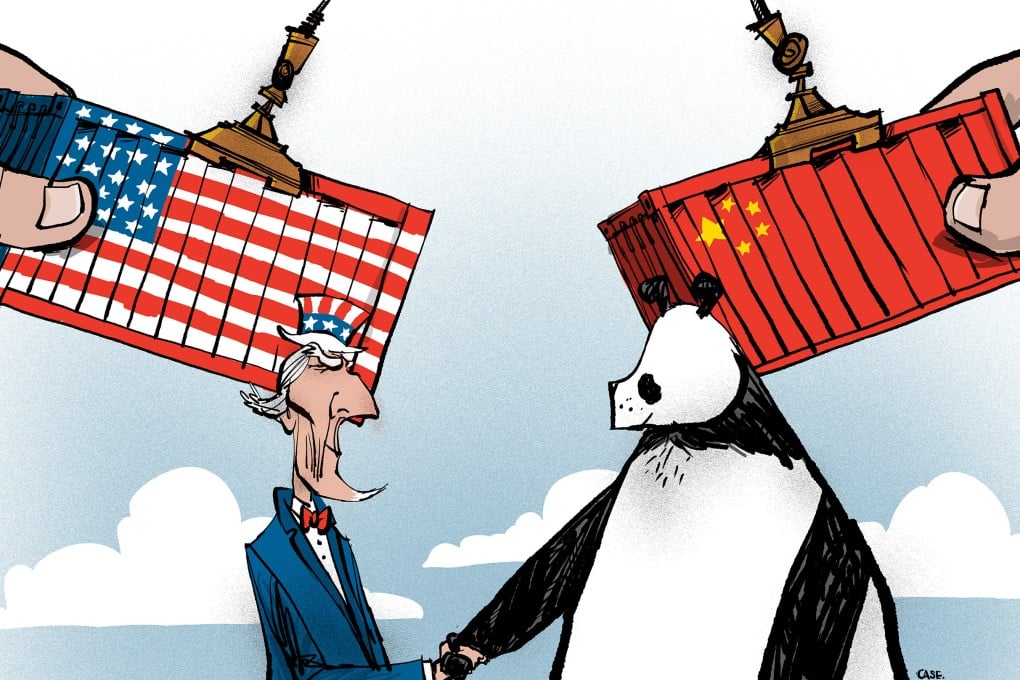

Opinion | For all the diplomatic reassurance, US-China trade tensions are growing

- As trade investigations into Chinese shipbuilding, steel and aluminium suggest more tariffs and a review of Trump-era tariffs unlikely to end in a rollback, expect China to respond with force

A flurry of US trade actions targeting China point to a looming intensification of the US-China trade war and raise questions over whether the relationship is moving towards more stable ground, as officials have recently asserted.

The steel and aluminium tariffs are economically dubious but politically imperative, while the shipbuilding investigation is all but certain to uncover Chinese subsidies, and the tariff review is likely to formalise Biden’s embrace of Trump-era tariffs. Expect China to hit back hard against any additional levies.

The economic rationale for tripling tariffs on China’s steel and aluminium exports is mixed. Previous punitive tariffs had all but closed the US market to Chinese imports. China’s share of US steel imports was a paltry 2 per cent last year – hardly a flood requiring the protection of tariff tripling.