Exclusive | China’s battle plan against tycoons prompts Xiao Jianhua firm to sell US$23 billion of assets

Beijing is taking three approaches to conglomerates that have ramped up risks with their involvement in financial sector

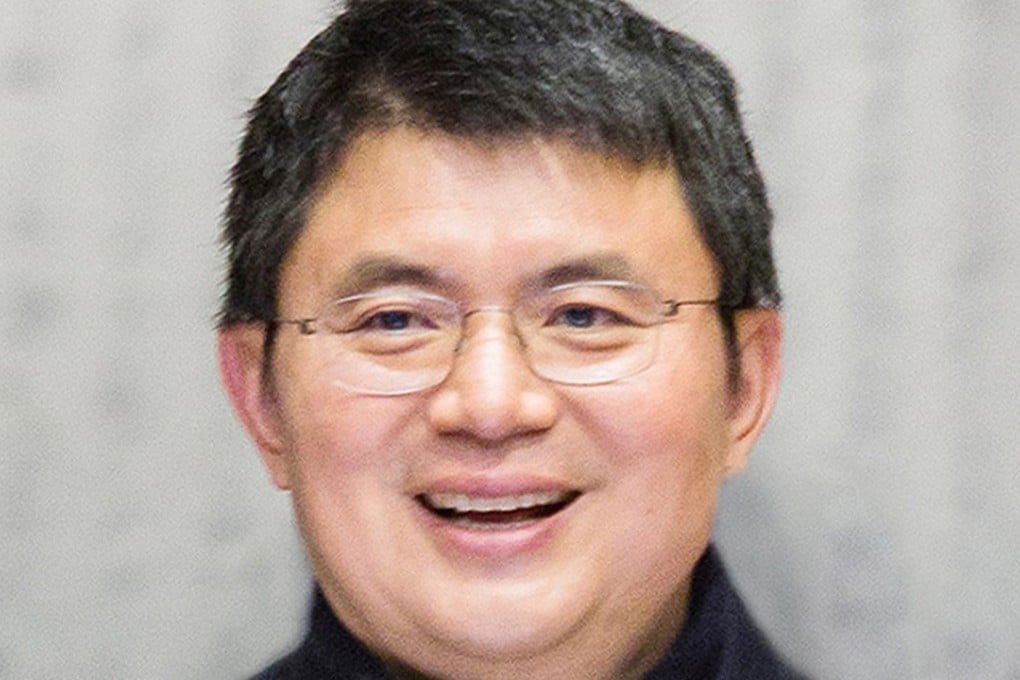

The business empire controlled by Chinese tycoon Xiao Jianhua will divest itself of 150 billion yuan (US$23.7 billion) worth of assets this year to repay bank loans, after offloading investments of about 100 billion yuan since he returned to the mainland from Hong Kong in mysterious circumstances early last year, a well-informed source told the South China Morning Post.

Tomorrow Holdings, Xiao’s primary corporate vehicle, and a vast network of affiliated ventures were divesting assets under directions from the Chinese authorities because his opaque business, with hundreds of corporate vehicles, had accumulated risks high enough to endanger the country’s financial security, the source said.

Proceeds from the sale of the assets are meant to be returned to the state banks, the source said.

It is part of Beijing’s efforts to prevent systemic risks in China’s financial industry, with a number of private conglomerates targeted for excessive borrowing. President Xi Jinping has listed financial risk control as a top priority for the country over the coming years. The process of streamlining Xiao’s empire is meant to be a “showcase” of financial risk control, the source added.

“Instructed” divestment, as in Xiao’s case, is one of three approaches Beijing has adopted to deal with tycoons. Property and investment conglomerate Dalian Wanda Group, owned by Wang Jianlin, and airline and property conglomerate HNA Group had been told to do similar things, the source said, with both having rushed to sell assets.