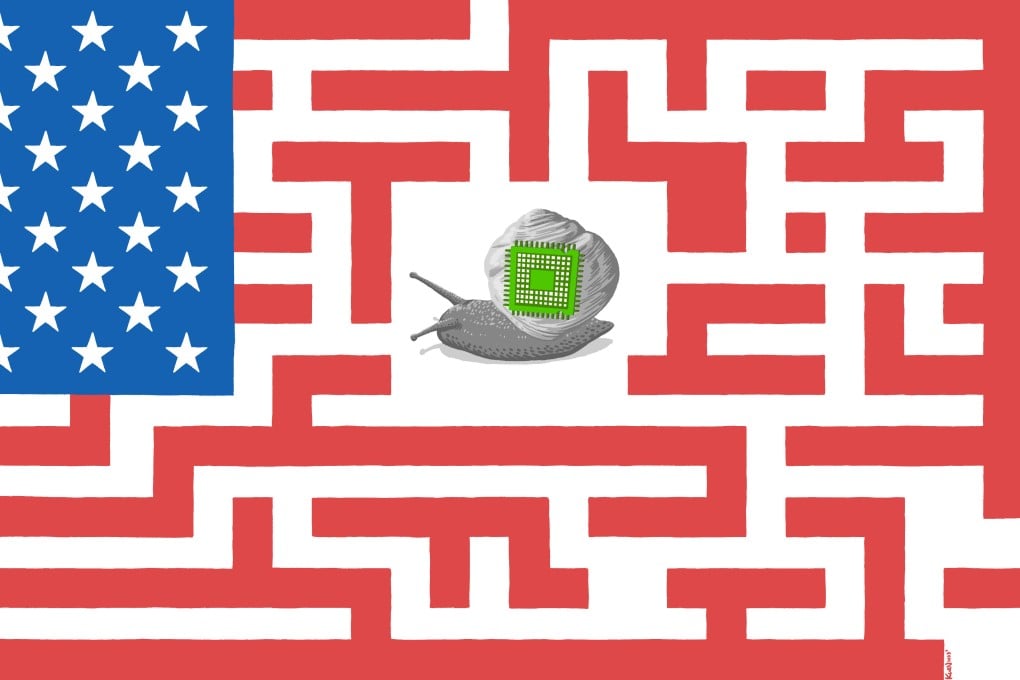

New semiconductor factories are rising in US, but billions in Chips Act money has yet to flow

- Chip makers are awaiting US$52 billion in federal incentives to help American companies ‘win the race for the 21st century’ against China

- Industry experts disagree on whether the pace of funding is frustratingly slow or just typical of officials being careful with a massive new programme

The White House said the legislation, which offers US$52 billion in federal incentives to support the immediate need to onshore advanced chip manufacturing, will help American companies “win the race for the 21st century” against China, which has significantly closed the gap in military and tech capabilities.

But more than a year after the bill’s passage, no money has been distributed for domestic chip production and research incentives. China, in the meantime, has demonstrated the ability to get around the Biden administration’s restrictions on the export of semiconductor technology from the US and its allies.

“I think there was a pretty good, pretty realistic expectation that the implementation would not be easy, and it has proven to be probably worse than it had been expected,” said Daniel Newman, CEO of the Futurum Group, a tech research and advisory firm based in Austin, Texas. He attributed the waiting time to “red tape” and “the slow-moving government”.

According to Bill Drexel of the Centre for a New American Security, a think tank in Washington, the US is working on a “very uncertain timeline” since it remains an “open question” as to how long it will take China to catch up on advanced chips.