Editorial | Fast action on ruling out capital gains tax reassuring for city

- Financial Secretary Paul Chan makes it clear that it is neither the time nor Hong Kong the place for such a measure

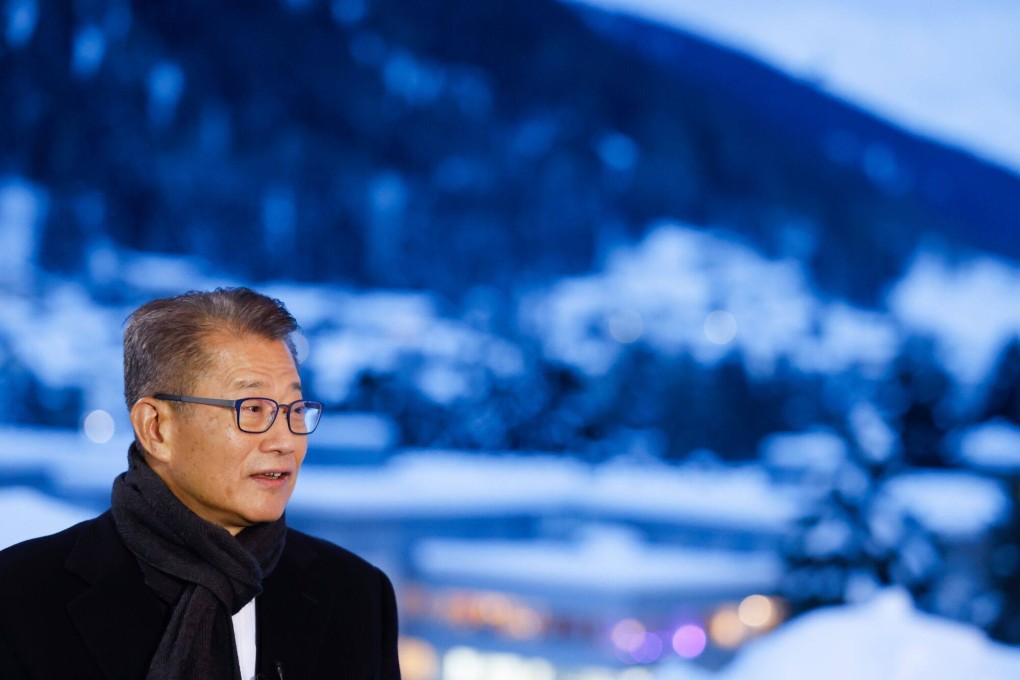

When something that is not happening gets people excited you know it has to be too controversial to contemplate. The spectre of a capital gains tax on assets in Hong Kong can be relied upon to do that if it is not unequivocally and quickly ruled out. A case in point arose in a Post interview with Financial Secretary Paul Chan Mo-po, in which he clarified the tax issue from Davos in Switzerland, where he is among finance officials, bankers, businesspeople and economists at the World Economic Forum.

Chan ruled out such a tax for the “foreseeable future”. The circumstances that gave rise to the need for clarification may be put down to a misunderstood choice of words. The financial secretary is consulting the community in the lead-up to his budget next month. The introduction of a capital gains tax was just a suggestion that came up at one of his consultation sessions, in the context of the economy not doing so well and the need for new revenue streams.

“Many people had different opinions,” Chan told the Post. “As a responsible government, we must do our due diligence.” He said during the consultation he would consider the option of such a tax. Therefore the perception of a need for clarification. Investment bank JP Morgan had warned that the introduction of a capital gains tax could trigger panic sales in the property market.

Ruling out the tax, Chan said any adjustment would affect the existing system’s competitiveness and the city’s economic conditions. He also dismissed the idea of a departure levy on travellers as suggested by the pro-business Liberal Party. When Hong Kong is trying to promote its image as a place where people can come and go and do business freely, a departure tax sends the wrong signal.

“Any adjustment to our tax system impacts a number of things and we have to be very careful,” Chan said. “For example, the competitiveness of our tax system, overall economic situation, the impact on our people and business, and business spending in Hong Kong. So it seems, in the foreseeable future, Hong Kong does not have the conditions to implement a capital gains tax.”

He is right. Timing is everything in politics and economic management. Now is not time to introduce a tax that may be potentially devastating, with the economy yet to recover from the pandemic slowdown. It is more likely to encourage capital flight. Moreover a capital gains tax is a bull-market tax, when prices are high and policymakers are striving to stifle speculation in assets. Now is exactly the wrong time to introduce it.

In keeping with the spirit of consultation one should be open to all ideas. But Chan needed to quash any speculation about a capital gains tax. Markets, investors and property owners can be reassured.