Advertisement

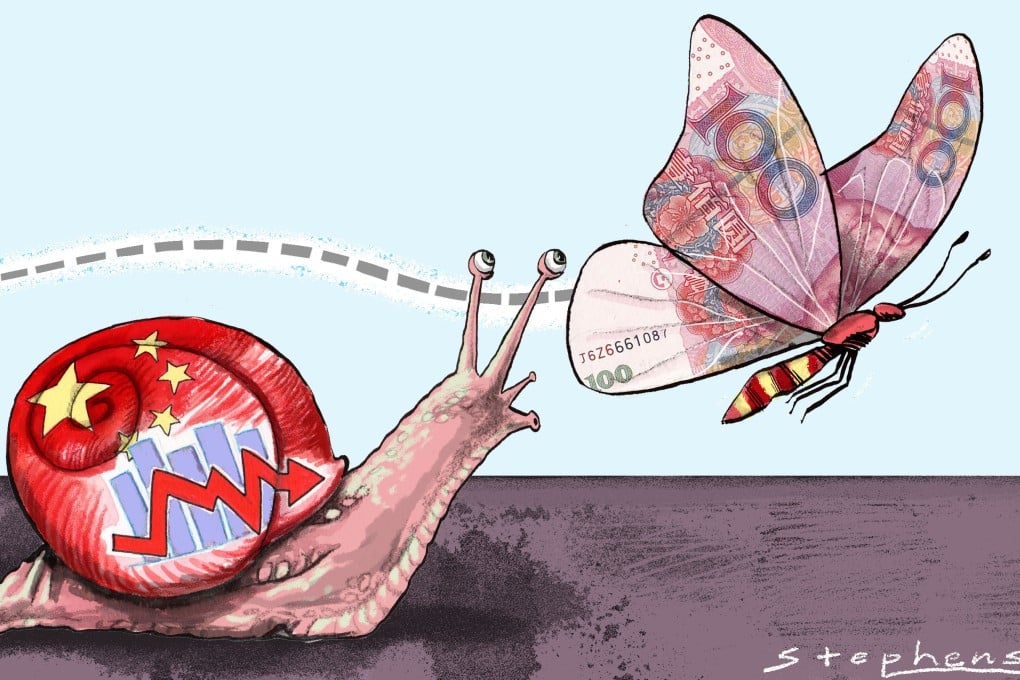

Opinion | China must look beyond short-term recovery to focus on its long-term economic transformation

- China’s economy is entering a new phase of slower growth and policymakers need to respond

- Officials must reaffirm their support for private enterprise, while doubling down on green investments to encourage sustainable and high-quality growth

Reading Time:4 minutes

Why you can trust SCMP

1

A China slowdown was always on the cards – the economic history of development and industrialisation cycles in Asia and elsewhere show us as much. The four Asian tigers started fast, with growth accelerating rapidly, and for an extended period they significantly outperformed advanced economies, as their economies and societies evolved.

Advertisement

But this period of rapid catch-up is not endless. As any country – even mighty China – gets closer to the level of sophistication of advanced economies, the growth engine will slow, and enter a new phase. The precise timing of this tipping point is hard to judge, but not its inevitability.

In 2023, multiple challenges facing China in the Year of the Rabbit are striking for their size, complexity and interconnectedness. President Xi Jinping must confront the suddenness of the slowdown, with growth close to a 46-year low at 2.9 per cent in the fourth quarter of 2022.

We can debate the political and economic interconnections of the zero-Covid and post-zero-Covid policies and responses. But the impacts are real. China’s stock markets slipped, and then recovered somewhat.

But housing is the bearer of really bad news. House prices in 100 cities have fallen for six months straight, and consumer confidence has dropped. China’s policymakers face a series of economic shocks that could spur negative dynamics, exacerbating the extent of the slowdown and its short-to-medium-term effects on stability.

Advertisement

Policymakers need to respond by being consistent in messaging and actions related to the continued importance of the market economy to China’s future prosperity. Recently, there have been signals from figures such as Guo Shuqing of the People’s Bank of China (PBOC) that the central bank understands the importance of China’s dynamic private enterprises. But will they be sufficient? I don’t believe so.

Advertisement