Opinion | Thanks to the Fed’s excesses of 2008, the world is bound for another economic disaster

- Instead of fixing the imbalances of the global economy, the Fed flooded the system with liquidity and kept interest rates low, sparking a speculative frenzy that has lasted to this day

- By buying government bonds to shore up pension funds, the Bank of England has shown the world how a looming crisis could play out

The world’s central banks are probably going to have to buy up bad assets to contain a looming financial crisis. This would slow down their fight against inflation, and result in higher inflation for longer. By extension, interest rates would go higher and stay there longer.

Thus, while a 2008-style financial crisis could be avoided, the higher interest rates would force asset markets to deflate anyway. To put it another way, the world would be swapping the financial explosion of 2008 for implosion.

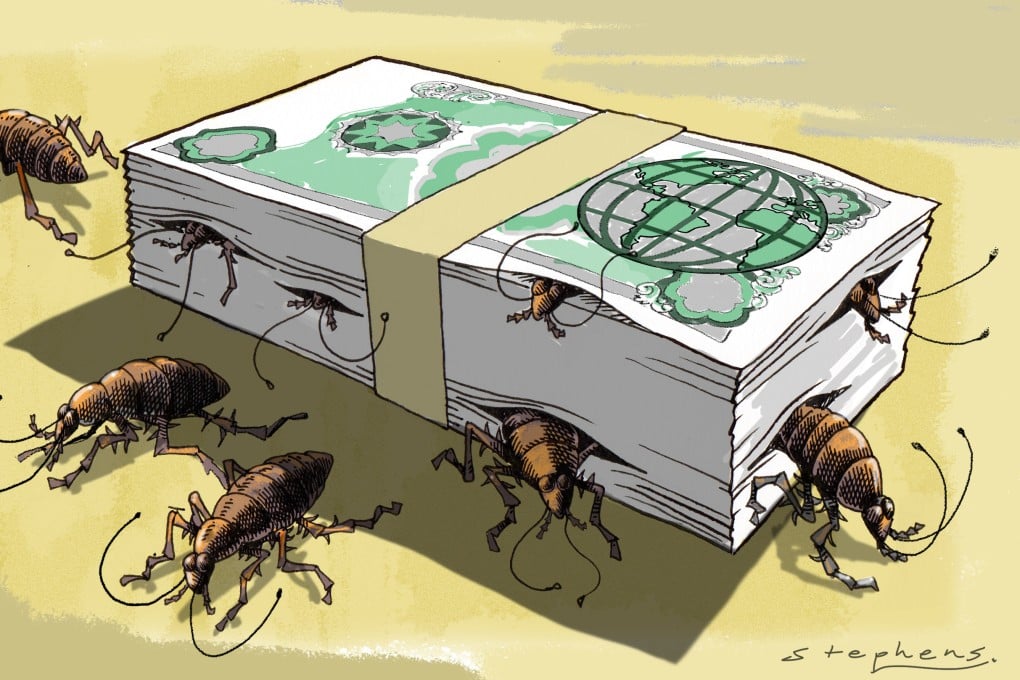

As the “cockroach theory” of markets goes, when you see one cockroach, many more are hiding. This seems to apply to high finance too.

The British pensions crisis is a warning about the fixed income industry. Super low interest rates in the wake of 2008 led to desperation among fixed income managers, who became susceptible to quack theories about low-risk yield pickups. There are probably a lot more fixed income funds around the world that have engaged in dodgy stuff.