Advertisement

The View | As inflation sticks and recession hits, prepare for five years of hard times

- US policymakers, who were wrong about inflation last year, are now telling the world to expect ‘some pain’

- With serious recession around the corner globally, all asset prices will fall, but investors must be patient and hold the course, with ‘preservation of capital’ as the maxim

Reading Time:4 minutes

Why you can trust SCMP

3

Around 1900, the future US president Theodore Roosevelt articulated his foreign policy through the West African proverb, “Speak softly and carry a big stick; you will go far.”

Advertisement

Roosevelt’s policy – which, by the way, came from a man as fond of macho poses, bare-chested or on horseback, as Russian President Vladimir Putin – is of great relevance today. Peaceful negotiation, without histrionics, shows respect for one’s opponents, while making it clear that you are an equal.

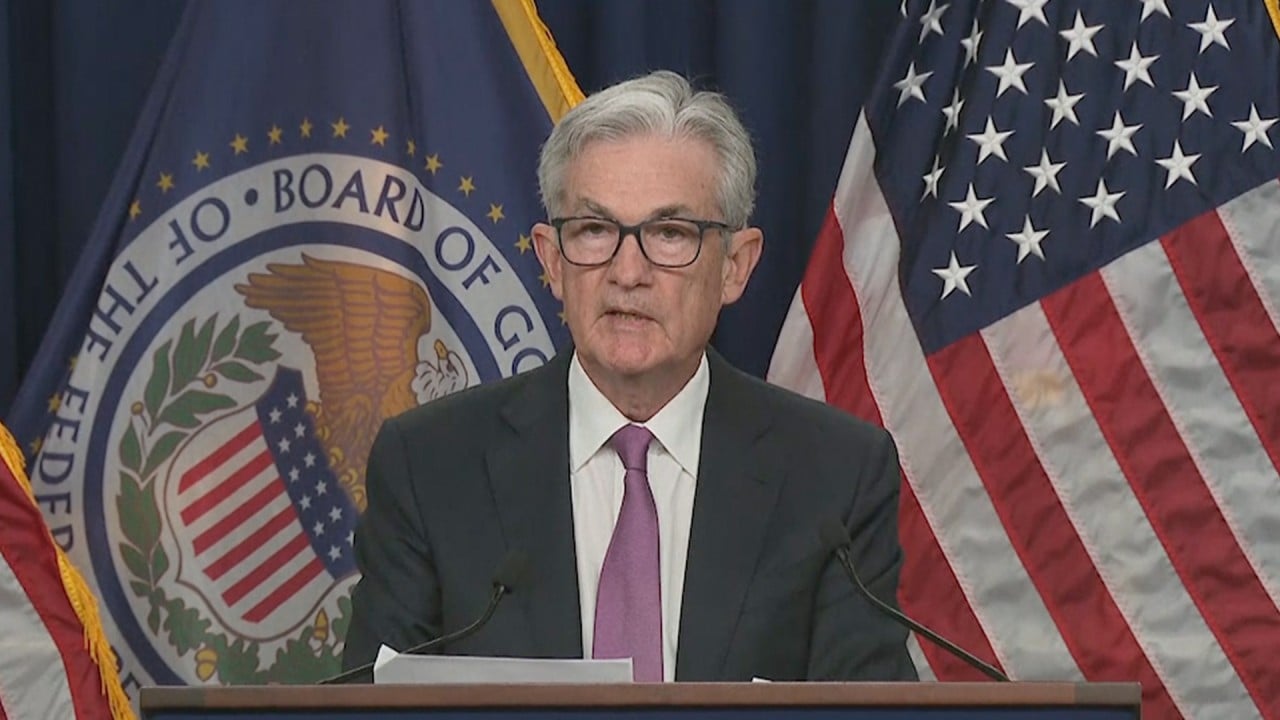

Jerome Powell, chairman of the US Federal Reserve and the man responsible for determining US interest rates and the strength of the country’s currency, and for maximising employment, is a central banker. In central banking, the mantra seems to be: speak loudly (because there is not a lot behind it). Mario Draghi, when he was president of the European Central Bank, calmed markets with the “whatever it takes” policy to support the euro in 2012, when a landslide of debt threatened Europe.

In 1983, then-Hong Kong financial secretary John Bremridge pushed through the Hong Kong dollar peg with the force of his personality. He was quoted as saying that the famous mid-range rate of 7.80 was “a number off the air” – as it happens, it’s worked brilliantly for close to 40 years now.

Speaking loudly is a highly successful policy – but if it fails, it is a paper tiger. Once your opponents realise that you are full of sound and fury, signifying nothing, your credibility will be shot.

Powell’s long-awaited, nine-minute speech to the world’s assembled finance industry power brokers at Jackson Hole in the US state of Wyoming last week has the hallmarks of a paper tiger. The Fed’s low interest rate policy had been accompanied by too much misguided money-printing for too long, and mirrored by too many other central banks, overheating the global economy.

Advertisement

His characterisation last year of burgeoning inflation as “transitory” was derisory, and events over the last year have proved him to be plain wrong. Now policymakers blame Covid-19 and the Russians, and are saying that the cure is high interest rates – another fine mess they have got us into.

The Fed bottled the needed increase in interest rates for the best part of a decade for fear of causing a small and temporary recession – and now Powell is warning us that the man in the street is going to suffer “some pain”, a euphemism to describe rampant inflation eroding savings, high interest rates ravaging businesses, and recession destroying careers. That is not a good combination for social harmony.

Advertisement