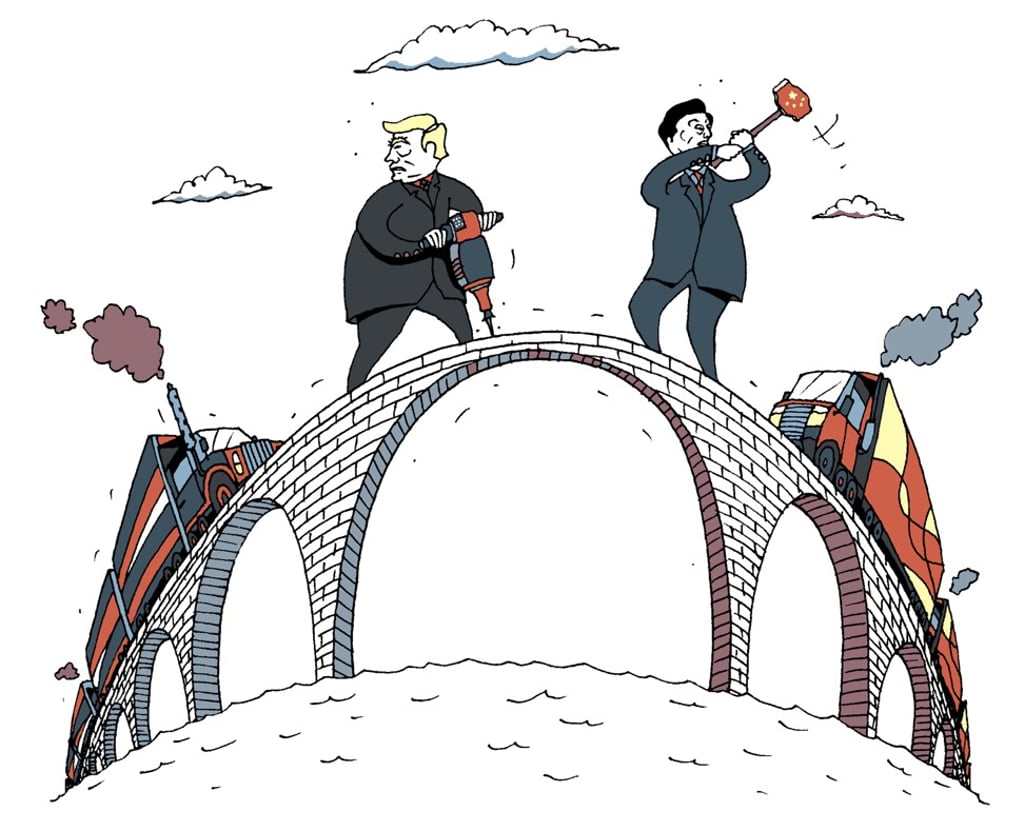

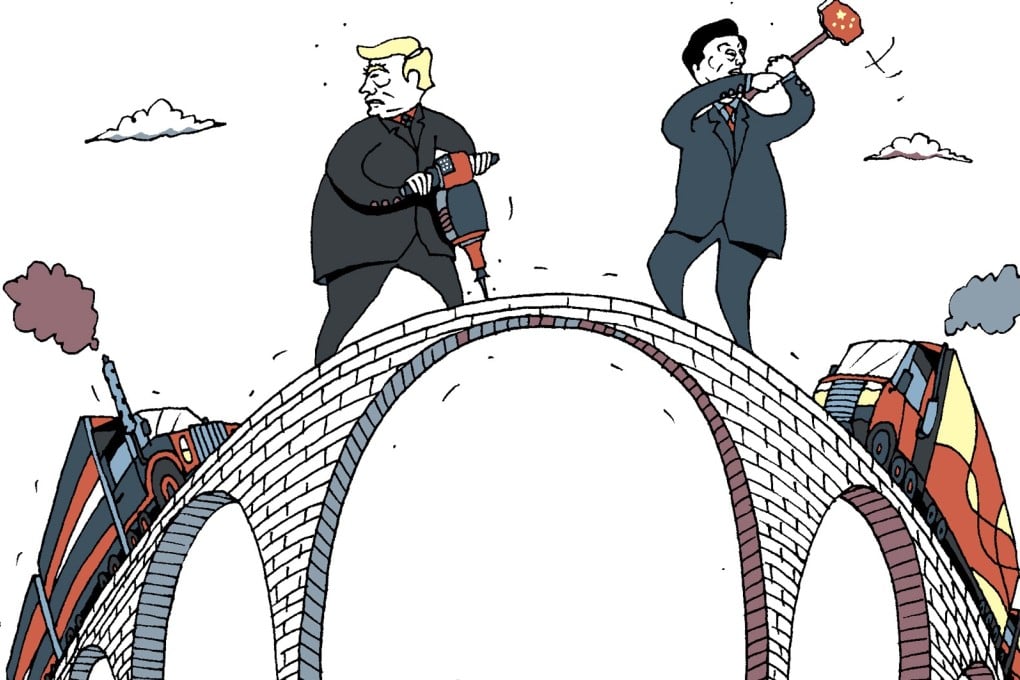

The US and China can beat the trade deficit with a treaty, not all-out war

Lawrence J. Lau says the first US-China economic dialogue ending without an agreement was not wholly unexpected, and calls for a bilateral investment treaty as a winning way to the future for both countries

US-China trade must be a two-way street

Further, it is useful to note that neither China nor the US are accustomed to treating another country as a friendly equal. This makes negotiations between the two more difficult, because the usual proven approaches that work with the other countries do not necessarily work in this case.

China upset at high US tariffs on steel imports

Some of the American demands at the dialogue were actually not supported by even US businesses. For example, the lowering of automobile tariffs in China is not welcomed by General Motors or Ford, which have large manufacturing operations in China and benefit from the existing tariffs. The US threatened to impose quotas or tariffs on the imports of Chinese steel and aluminium. But these Chinese goods account for only a very small percentages of the total US imports of steel and aluminium, and will do very little to narrow the trade deficit. So any such action is merely symbolic.

The bilateral trade deficit is actually not as large as it appears