Advertisement

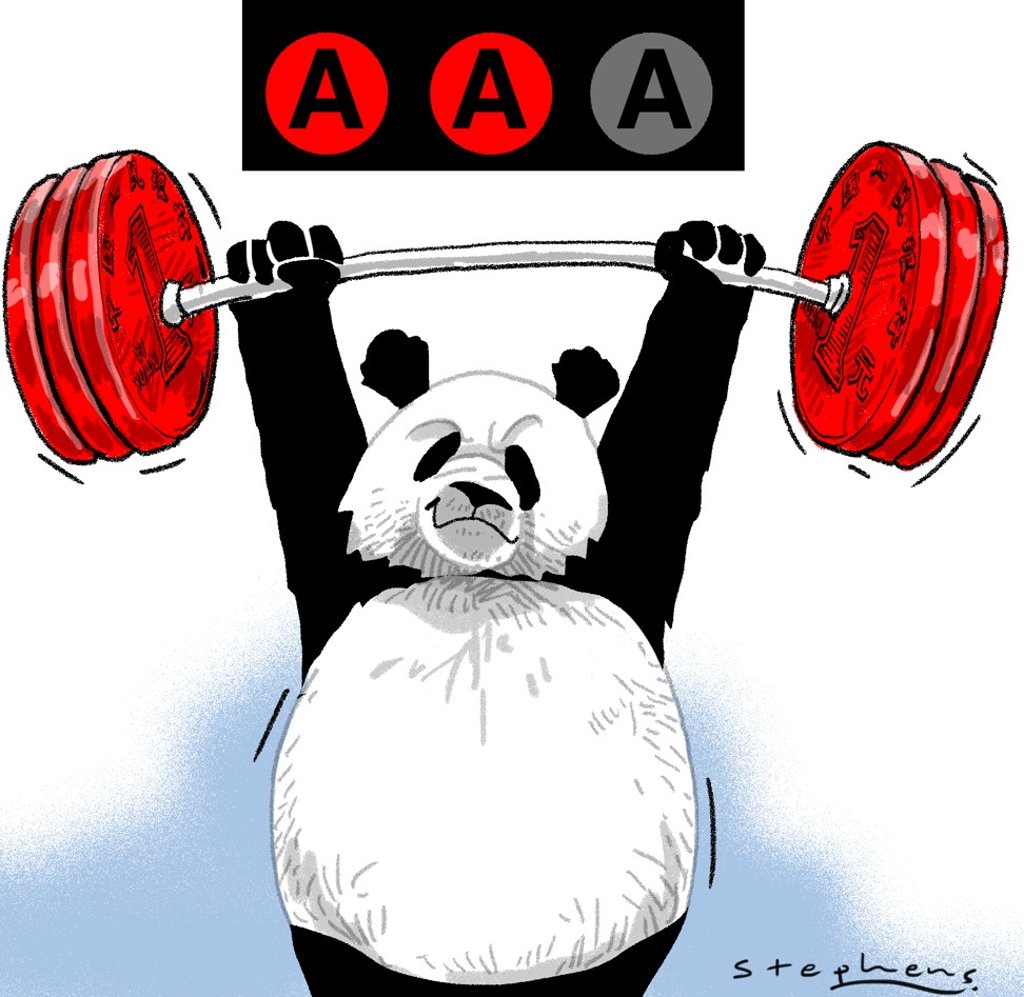

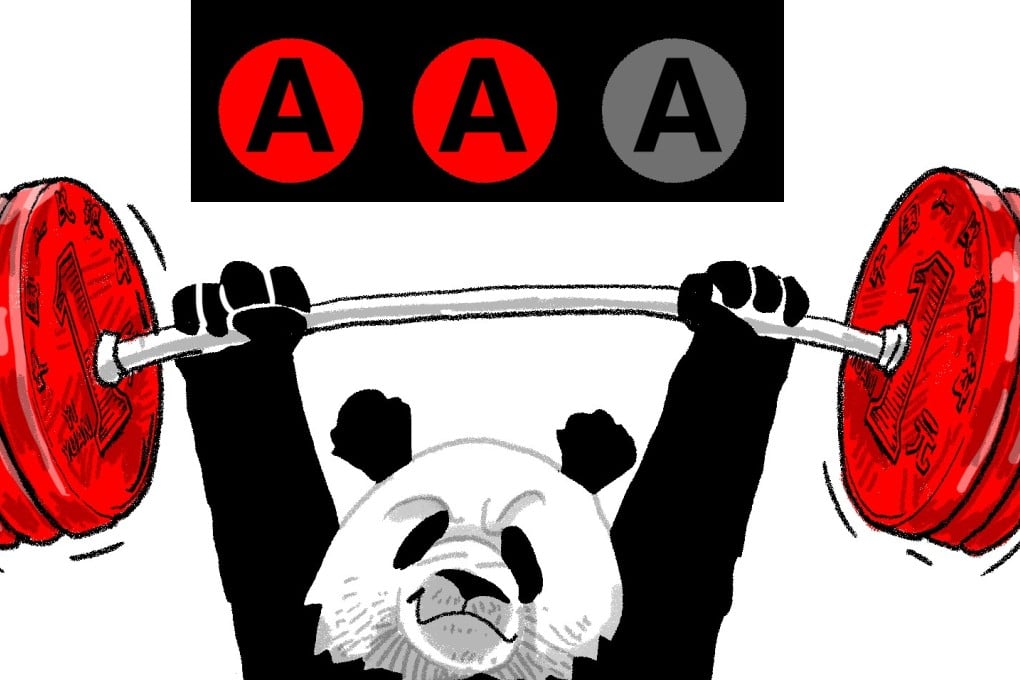

Moody’s downgrading of China’s credit rating is without basis amid ‘new normal’ in the economy

Lawrence J. Lau says the mainland Chinese economy remains stable, with structural reforms under way, and if demand or debt are concerns, the central government has a proven ability to mobilise resources to achieve its goals

Reading Time:5 minutes

Why you can trust SCMP

Advertisement

Moody’s recently downgraded China’s sovereign credit rating for the first time since 1989, and changed the outlook for its economy from stable to negative. It also downgraded Hong Kong on the basis of its close economic relationship with mainland China. Are these downgrades justified?

First, central government debt is only about 20 per cent of gross domestic product, with more than 99 per cent denominated in renminbi.

China should have no difficulty in meeting these obligations, just as the US, with a public debt-to-GDP ratio approaching 100 per cent, should have no difficulty meeting its obligations – which are all denominated in US dollars. Both countries can simply print more money to service their respective debts.

China hits back at Moody’s for downgrading its credit rating

Thus, to the extent that the credit rating should reflect the ability to service the debt, there has been no substantive change for China.

No credit agency foresaw the 2008 collapse of Lehman Brothers, the ensuing global financial crisis, or the European sovereign debt crisis

Advertisement