Mainland China banks embrace preferred shares but investors are left guessing

After Beijing's nod, mainland banks are preparing to issue 310b yuan in preferred shares, but complex rules add to the confusion in the market

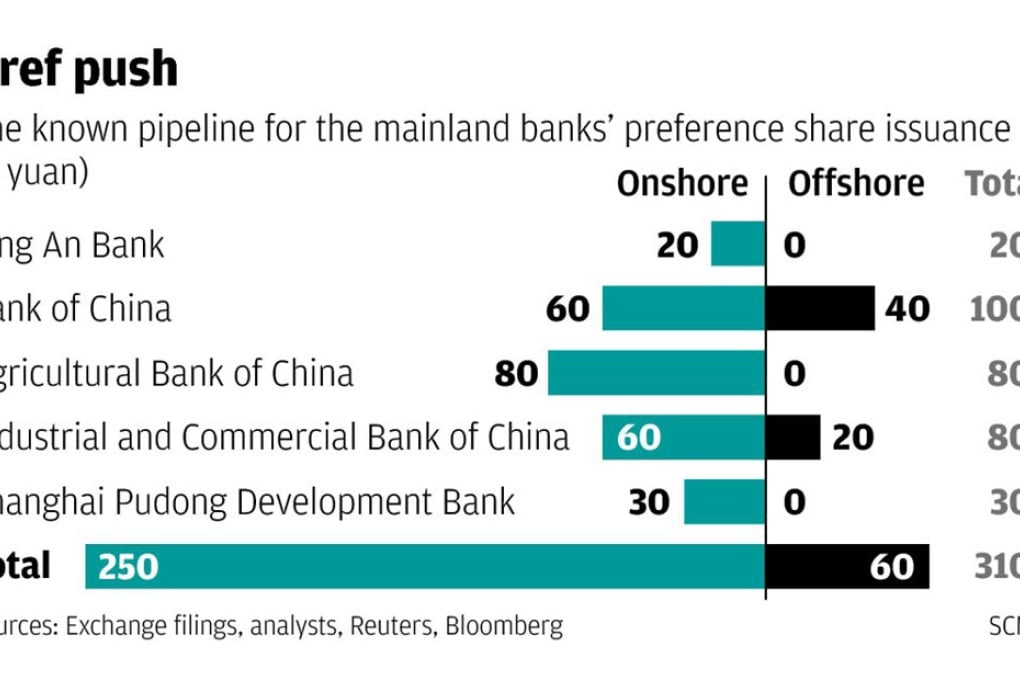

These are transformational times for the mainland banks as they line up about 310 billion yuan (HK$387 billion) of preferred share issuance, including a 20 billion yuan offer from Ping An Bank announced on July 15.

Industrial and Commercial Bank of China (ICBC) has mandated book runners for its offshore offer (said to be Bank of America Merrill Lynch, BNP Paribas, China International Capital Corp, Deutsche Bank, Goldman Sachs, ICBC and UBS) and Bank of China is expected to soon invite banks to pitch for its own offshore deal.

Citic Bank and Guangfa Bank are also sizing up plans for their own preference share offerings.

Preference shares are a kind of wonder security for the banks. They provide quasi-equity funding that can be applied against their tier-1 capital without diluting their return on equity. Furthermore, they let the bank raise this capital when a straight equity issue might not be possible because of rules prohibiting new share issues from banks trading below book value.

There are many complicated issues, [making it hard to price] these securities

However, investors and bankers are already complaining that such instruments are too inflexible.