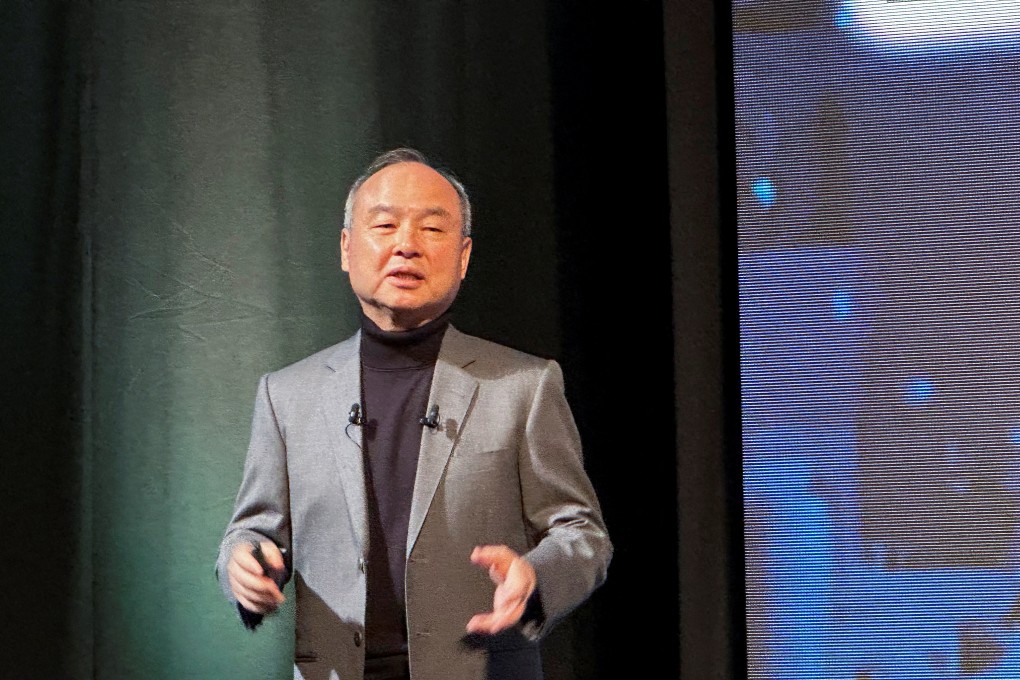

SoftBank founder Masayoshi Son adds US$4 billion to his wealth on Arm’s 192% rally

- The 66-year-old Japanese tycoon was worth US$15.1 billion as of Tuesday, compared with US$11.3 billion at the end of last year

- Son is personally benefiting from Arm’s rally because he owns roughly a third of SoftBank, which holds 90 per cent of the UK chip designer

Masayoshi Son has added about US$3.8 billion to his net worth this year as the surging stock price of Arm Holdings bolsters the value of his holdings in SoftBank Group.

The pace of increase in his wealth puts the Japanese billionaire in the top 30 gainers among the world’s 500 richest people tracked by the Bloomberg Billionaires Index. The 66-year-old founder of SoftBank was worth US$15.1 billion as of Tuesday, compared with US$11.3 billion at the end of last year.

Son is personally benefiting from Arm’s rally because he owns roughly a third of SoftBank, which holds 90 per cent of the UK chip designer. Arm extended its three-day rally to 90 per cent after its earnings report last week showed spending on artificial intelligence (AI) is boosting sales. The stock has now almost tripled from its initial public offering price of US$51. SoftBank shares are trading near a three-year high.

“As long as its assets hold up their gains, people are not going to say SoftBank is over priced,” said Masahiro Yamaguchi, senior market analyst at SMBC Trust Bank. “For Arm, the stock surge may look overheated but if you think this will be backed by solid earnings growth in the future, it doesn’t feel out of place.”

Arm gave a bullish forecast when it reported financial results last week, suggesting the company can push beyond its traditional smartphone business into AI and other promising markets. Yamaguchi said investors are likely to take cues from Nvidia’s earnings next week to gauge whether the latest gains have been excessive.