Cobalt, lithium and nickel are booming due to China’s insatiable appetite for electric vehicles

World prices of cobalt, lithium and nickel are booming as China’s insatiable need for the battery packs used in electric vehicles drove up demand, recreating the economic bonanza that fuelled commodity-exporting countries a decade ago.

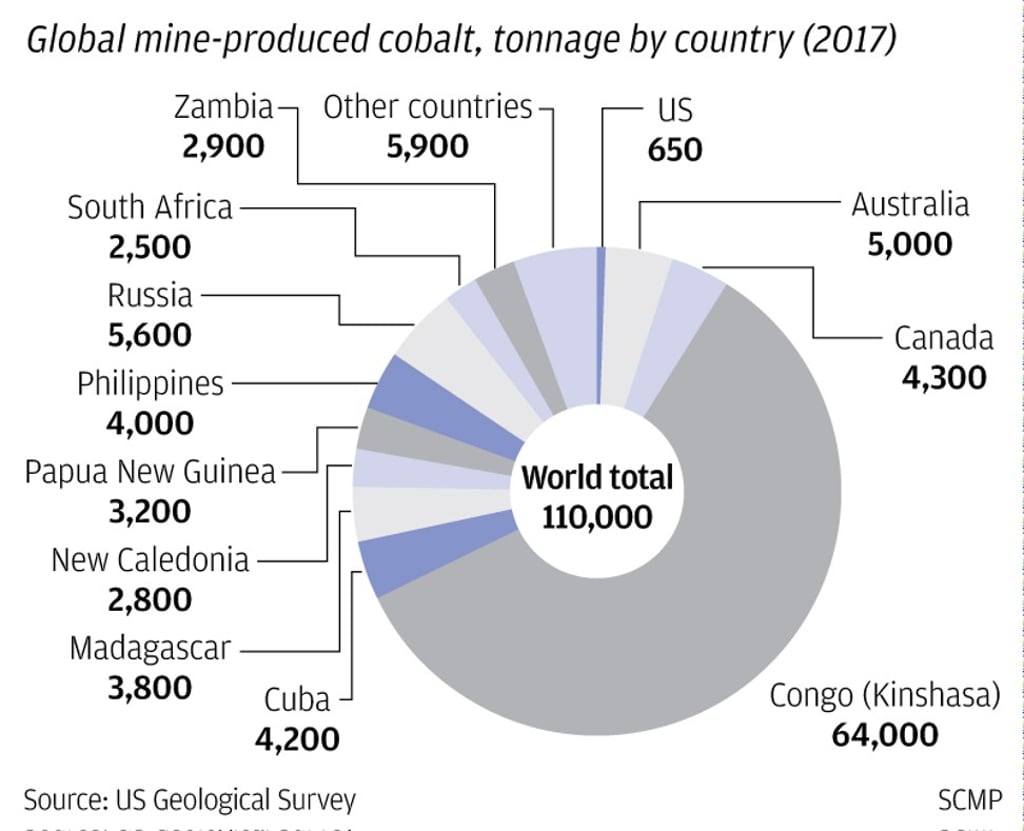

The price of lithium, a soft silvery white metal usually mined from brines, has soared by more than 300 per cent in the past two years. The price of cobalt, mostly mined as a by-product of nickel and copper, surged 129 per cent last year while nickel surged 4.6 per cent to a two-year high in London.

At the centre of the boom is China’s support for developing electric vehicles (EV) to reduce emissions of greenhouse gases.

Electric vehicles made up a mere 2.3 per cent of the 30 million vehicles produced last year, according to the China Association of Automobile Manufacturers. That proportion may quintuple to 12 per cent by 2025, according to a forecast by JPMorgan Chase & Co.’s analyst Nick Lai.

CATL, formerly known as Ningde Shidai, is now the world’s most valuable electric battery supplier. Once a little-known company based in Fujian province, CATL’s shares have more than doubled since its June 11 listing on the Shenzhen Stock Exchange, giving it a market capitalisation of US$23 billion.

“Capital prefers to chase after companies that have a leading position in a sector,” said Huatai Securities’ analyst Kong Lingfei.