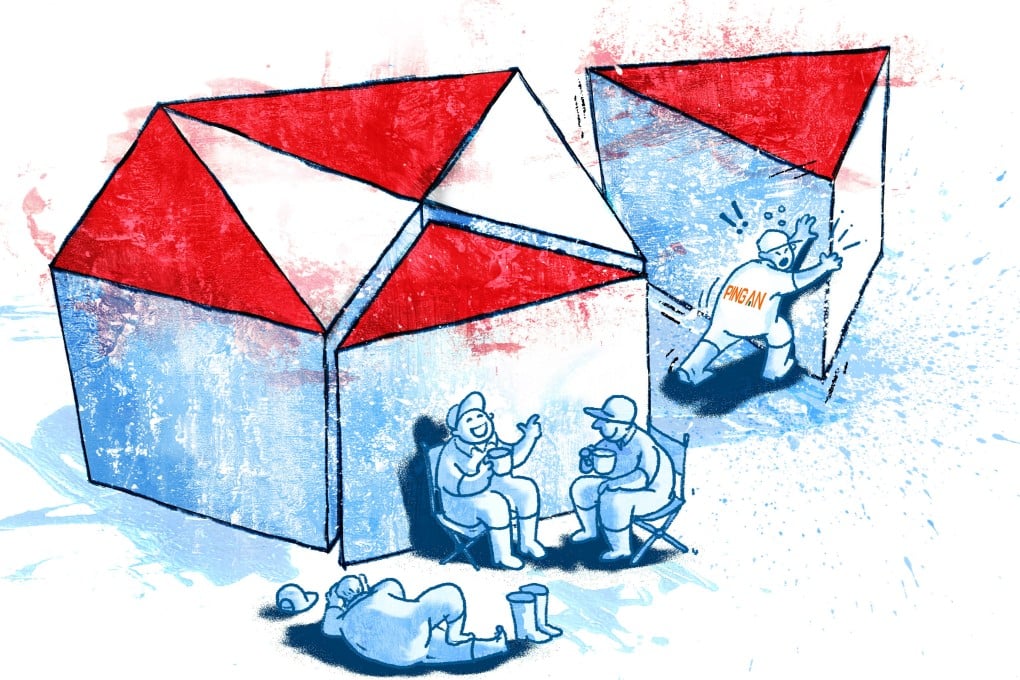

Breaking up HSBC: Ping An’s push to extract value from bank’s split fails to excite shareholders as unorthodox campaign enters its third month

- Ping An’s push to break up HSBC has failed to spur gains in bank’s Hong Kong share price, which is lagging the benchmark Hang Seng Index

- Chinese insurer pushing for change after bank’s 2020 dividend cancellation, recent share price performance

No major shareholder has publicly supported HSBC’s break-up since the bank’s biggest investor declared its hand in a surprise move in late April before the London-based bank’s annual general meeting. Analysts have subsequently expressed their scepticism about the potential value that could be unlocked, given the likely complexity and time needed to split one of the world’s largest banks, forged through more than a century of mergers that spanned the globe.

HSBC’s stock price, a key gauge of its major shareholder’s ire, remains stuck in neutral, as investors grapple with how they should place their bets after the Shenzhen-based insurer – owning 9.2 per cent of HSBC- called publicly for the biggest of Hong Kong’s three currency-issuing banks to be shaken up.

Many investors are standing back and waiting for Ping An to show them what they may be missing, said Hugh Young, the Asia chairman of Abrdn, which owned 1.3 per cent of HSBC as of March 31. “We don’t quite see the logic, [so] let’s wait and see what they come up with,” Young said. “We’re very much in the ‘remain to be convinced’ camp, which looks the same as the markets.”

Investors would like to better understand Ping An’s rationale and would be willing to support changes if it made sense for the company and shareholders, Young said.

“If we’re missing something, it would be useful,” Young said. “Like most investors, we’re open-minded about these things.”