Here’s how Naspers’ bankers executed the world’s largest block sale of Tencent shares without crashing Hong Kong’s market

- Naspers sale of a 2 per cent stake in Tencent marks world’s largest ever overnight sale of a block of shares and attracted US$60 billion worth of orders

- Deal priced at tighter discount than Naspers’ 2018 Tencent sale, despite China’s antitrust crackdown and Archegos Capital implosion

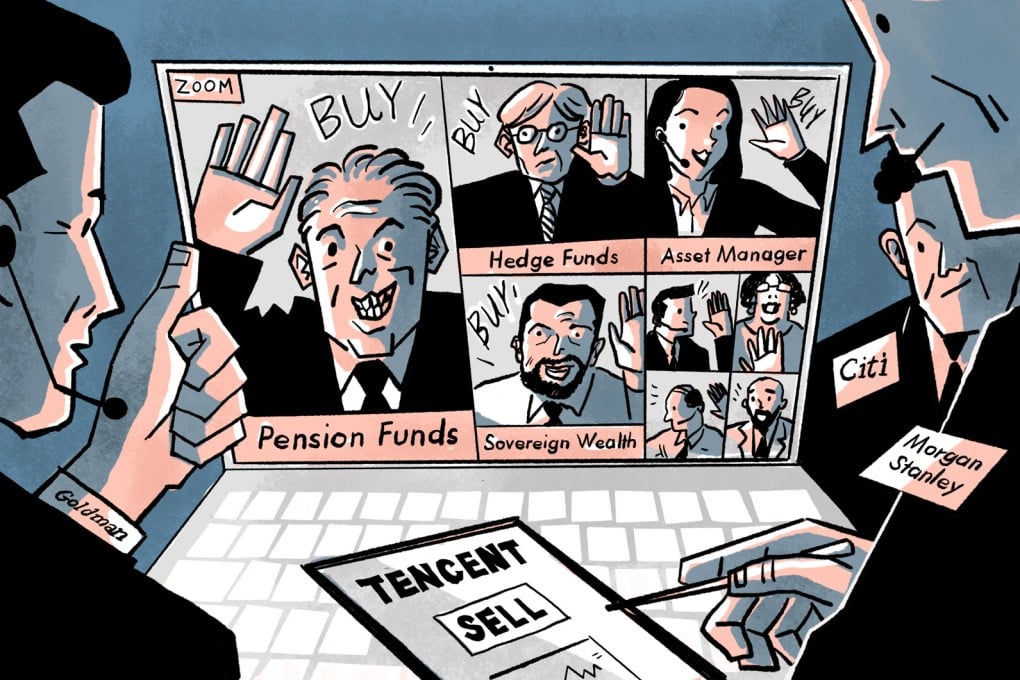

A sleepless, white-knuckled night awaited bankers at Goldman Sachs, Morgan Stanley and Citigroup on April 7 after the Hong Kong stock market closed, as they checked in with colleagues half a world away on Zoom Video Communications’ conferencing software.

The seller, Naspers of South Africa, was cashing in on one of the most successful venture capital investments of all time to finance its forays into other digital businesses. At its sale price, the Cape Town-based company had notched up a return of over 7,000 times on its investment, based on calculations by South China Morning Post.

To help clinch the deal, Naspers secretly briefed a small group of money managers 24 hours before the divestment. All in, US$60 billion worth of orders were queued up for the Tencent block that night including about 10 for around US$1 billion each, according to people familiar with the matter.

Tencent’s shares, which closed at HK$629.50 before Naspers’ Prosus unit announced its sale, never fell below HK$600 in the days since, keeping buyers well in the money above their HK$595 purchase price. The successful sale also underscored the depth and abundance of liquidity in Hong Kong’s capital pool, enough to rival US and European markets.