Jake's View | Money laundering and the fuss over ATM withdrawals in Hong Kong

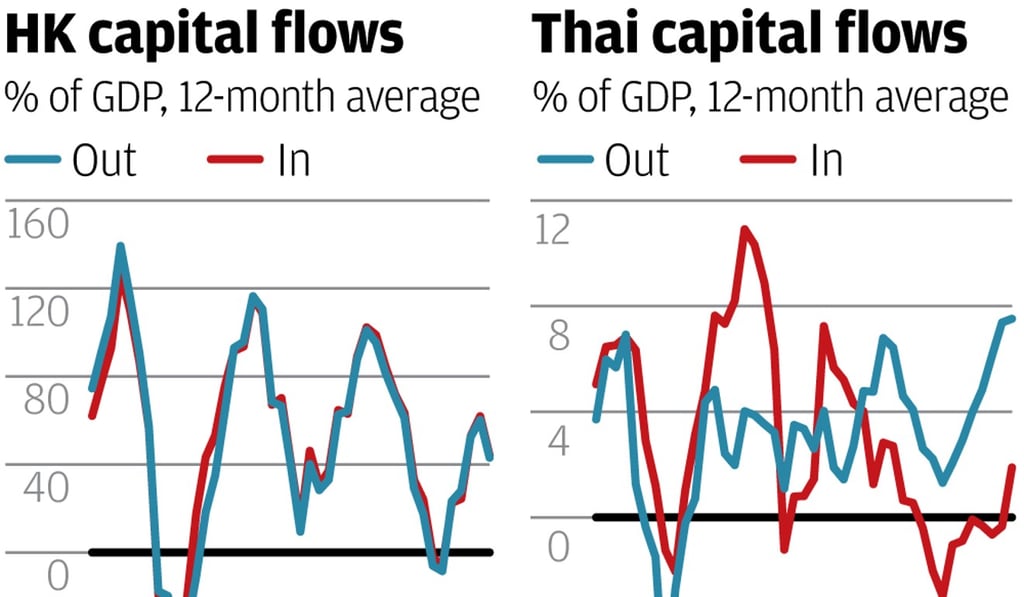

Total capital inflows to Hong Kong almost perfectly matched capital outflows from the city

Hong Kong banks have been hit by an unprecedented HK$20 billion per month surge in suspicious ATM withdrawals, exposing a loophole that could deal a blow to Beijing’s battle against illicit capital flight via its notorious underground banking system.

SCMP, January 26

Pardon me if you think the two charts here are only updated versions of ones I have earlier shown in this column. They are. But what they reveal is worth emphasising.

Two things immediately stand out here. The first is that the two are almost perfectly matched. At all times almost exactly as much flows in as flows out again.

The second is that these flows are enormous. Look at the left-hand scale. On three occasions over the last 10 years, annual inflows and outflows both exceeded HK$2 trillion or more than 100 per cent of GDP.

Think again about how very odd this is. What these official balance of payments statistics say is that three times over the last 10 years foreigners had so much confidence in the Hong Kong economy that they invested more money here than the value of all of the goods and services Hong Kong produced that year.