The big score: making or breaking China’s consumer credit market

If things go as planned, a growing army of data firms and credit-scoring outfits will use the information to pivot China towards a future powered by consumer spending

Eva Niu wants new boots and, like millions of young people in China, she’s hunting for a deal on Taobao, one of the world’s biggest online markets.

But unlike most online shoppers in China just a year ago, Niu will buy the boots on credit provided from within the same system she shops in. That’s quite a leap in shopping sophistication for a 22-year-old who has never considered going to a bank for a credit card.

“It’s hard for us college students to apply for credit cards,” the Beijing law school student says, pointing at strict rules at banks that she believes would disqualify her. “Maybe that’s why Ali credit is popular among the young generation.”

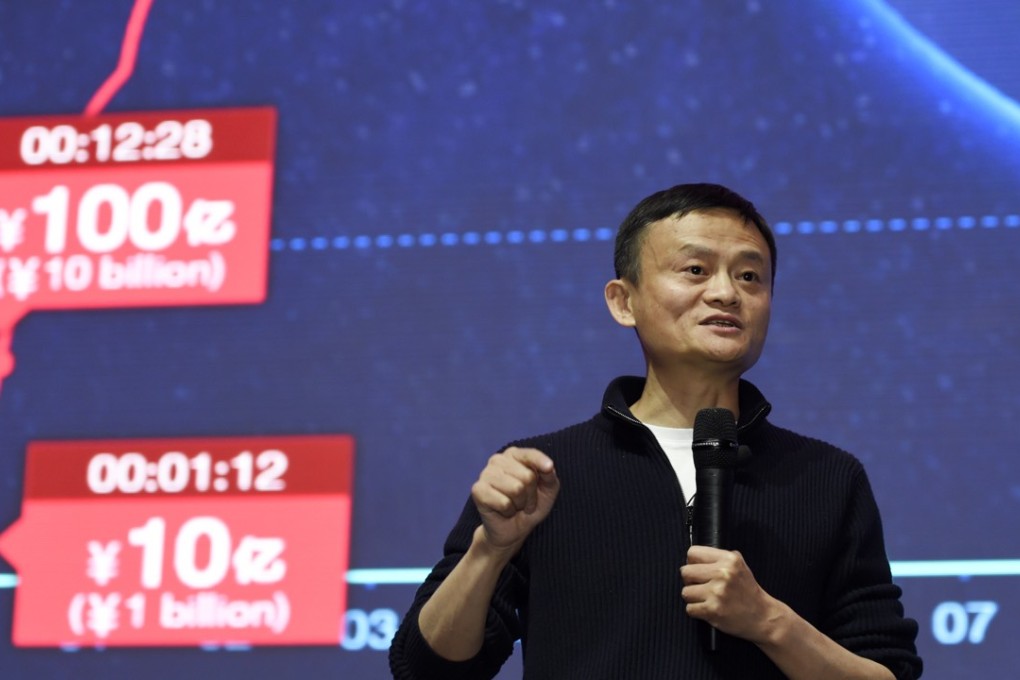

By “Ali credit”, Niu means the dense data-processing and credit-scoring operations at Sesame Credit, part of Ant Financial. Ant, in turn, is an affiliate of Alibaba, the New York-listed e-commerce giant that also owns Taobao and launched a licensed online bank this year.

Without Niu even asking for it, Taobao offered her a virtual credit card, called Huabei, with a credit limit of 4,000 yuan (HK$4,881) good only within Alibaba’s empire. Ever since she bought a bra on Taobao in 2010, the company has collected every snippet of her transaction data within the online mall. Those blips now feed into Sesame Credit to produce a credit score.

Behind Niu’s boots, the scoring, the helixes of data and the unsolicited credit, there is a cosmos of credit information sweeping through what has become in a few short years one of the world’s biggest markets for online payments and e-shopping.

If things go as planned, a growing army of data firms and credit-scoring outfits will use the information to pivot China towards a future powered by consumer spending, namely by better assessing the creditworthiness of the masses.