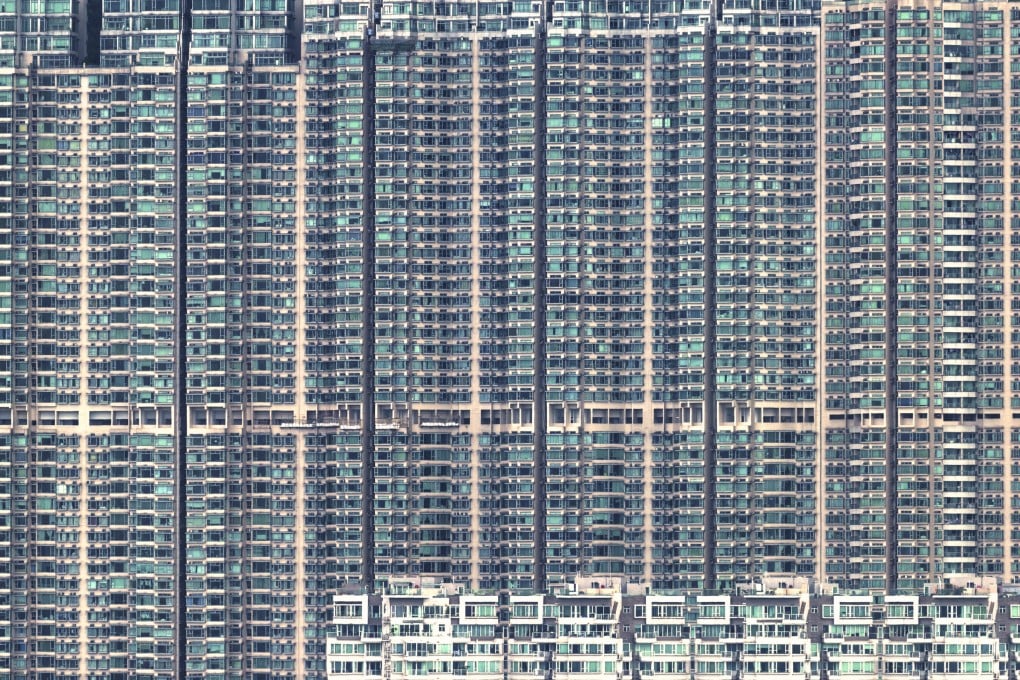

Concrete Analysis | Can Hong Kong property help investors ride out inflation?

- The favourable fundamental structure of Hong Kong’s real estate sector and steady supply-and-demand dynamics make it attractive to investors

- As quarantine restrictions continue to be eased, Hong Kong’s property sector is set to see renewed demand, driving prices higher

Inflation, the inflationary period we’re in, and how long this will last have been dominating the headlines lately.

As a macroeconomic phenomenon, one that impacts entire economies, we are all subject to it. Prices of daily essentials like milk, bread and eggs are rising, along with other crucial items like energy, for a host of reasons. Because of that, there has been some talk about hedging against inflation, too. So what, exactly, is a hedge?

Let’s say you own a red vintage sports car and you live in a neighbourhood considered a high risk for theft. Not only do you buy insurance against accidents and damage, it should also cover theft. You may not be able to stop the thief, but you can mitigate the financial pain of losing the car.

In a nutshell, that’s a hedge. A hedge is a sort of insurance policy for your investment, meant to reduce the risks associated with negative cost, value and pricing changes.

When the idea of hedging against inflation is applied to property, it is because conventional wisdom, backed up by years of data in many cases, suggests real estate tends to maintain its value over the long term and often rises during inflationary periods, while rents climb because of that same inflation. For investors, rising rental income is reflected as increased capital value.