Advertisement

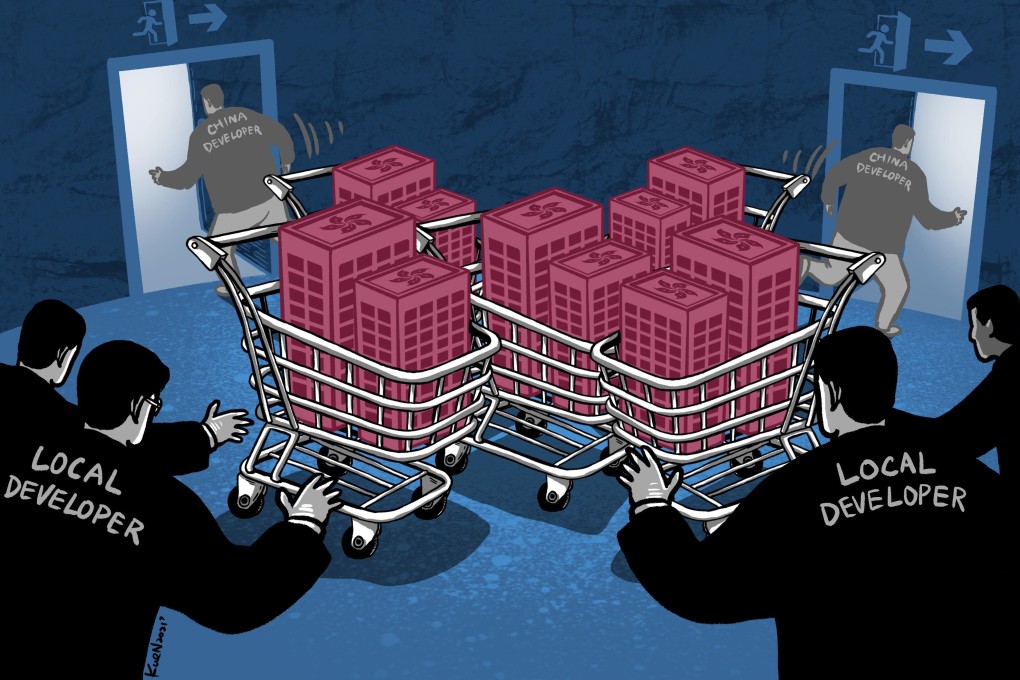

As Evergrande, Kaisa and other Chinese developers fall on hard times, Hong Kong’s bargain hunters swoop in

- Mainland Chinese developers bought seven sites each year during the Hong Kong government’s 2016 and 2017 land sales programmes

- By 2018 and 2019, their activities had dwindled to three each year, with only one deal so far in 2021

Reading Time:6 minutes

Why you can trust SCMP

3

Lui Che-woo, one of Hong Kong’s wealthiest men with a casino, hotels and apartments under his belt, met his match in late 2016 when his company K Wah International lost a bidding war to a Chinese airline that was on a land grab in the world’s most expensive real estate market.

The HNA Group, a conglomerate built around Hainan Airlines, paid a record HK$8.84 billion (US$1.13 billion) for a residential land plot at Hong Kong’s former Kai Tak airport, paying substantially over the market’s valuation. It was the opening salvo in a HK$27.22 billion shopping spree over four months that ended with HNA owning four parcels of prime land, each setting a fresh price record.

The HNA Group, a conglomerate built around Hainan Airlines, paid a record HK$8.84 billion (US$1.13 billion) for a residential land plot at Hong Kong’s former Kai Tak airport, paying substantially over the market’s valuation. It was the opening salvo in a HK$27.22 billion shopping spree over four months that ended with HNA owning four parcels of prime land, each setting a fresh price record.

Advertisement

“Mainland companies have the ability to do it, but we don’t,” Lui said in a November 24, 2016 interview with the Financial Times, adding that the flood of money from Hong Kong’s northern border was “distorting” the city’s land prices.

Lui, Asia’s second-richest man of 2016 according to Fortune, with his wealth estimated at US$8 billion, was not alone in feeling the threat of mainland China’s developers, whose deep pockets were lined by cheap – and sometimes unauthorised – financing. Wang On Properties Limited, a HK$1.3 billion developer, found Hong Kong’s land bank so unaffordable that it turned to renovating ageing flats for growth.

“Fierce competition for land is unavoidable in government tender exercises, and it’s hard for small players like us to get prime sites,” said Wang On’s chief executive Nick Tang Ho-hong, the son of the firm’s controlling shareholder Tang Ching-ho.

So is Far East Consortium International, a medium-size developer with HK$6.2 billion in capitalisation. It found Hong Kong’s land prices so unaffordable that it pivoted its growth strategy offshore to look for land in Australia, Singapore and the UK.

HNA, based in the Hainan provincial capital of Haikou, was neither the first nor the last of mainland China’s property developers to be snapping up land in Hong Kong. By the time HNA added a fourth Kai Tak plot to its portfolio in March 2017, China-based developers owned half a dozen parcels in the area designated as Hong Kong’s second central business district, taking up 53 per cent of the total square footage and 62 per cent of value.

Advertisement

Advertisement